- NASA – July 2022 tied with 2020 to be the 3rd warmest July on record, behind 2019 (warmest July recorded) and 2021 (2nd warmest July recorded).

NASA

___________

Dr. Robert Rohde - Not a great sign when the rate of glacier melting is literally going off the chart.: https://twitter.com/RARohde/status/1561639261643984896

Already shrunk by half, study shows Swiss glaciers are melting faster

Switzerland’s 1,400 glaciers have lost more than half their total volume since the early 1930s, a new study has found, and researchers say the ice retreat is accelerating at a time of growing concerns about climate change.

ETH Zurich, a respected federal polytechnic university, and the Swiss Federal Institute on Forest, Snow and Landscape Research on Monday announced the findings from a first-ever reconstruction of ice loss in Switzerland in the 20th century, based in part on an analysis of changes to the topography of glaciers since 1931.

The researchers estimated that ice volumes on the glaciers had shrunk by half over the subsequent 85 years — until 2016. Since then, the glaciers have lost an additional 12 percent, over just six years.

“Glacier retreat is accelerating. Closely observing this phenomenon and quantifying its historical dimensions is important because it allows us to infer the glaciers’ responses to a changing climate,” said Daniel Farinotti, a co-author of the study, which was published in scientific journal The Cryosphere.

By area, Switzerland’s glaciers amount to about half of all the total glaciers in the European Alps.

The teams drew on a combination of long-term observations of glaciers. That included measurements in the field and aerial and mountaintop photographs — including 22,000 taken from peaks between the two world wars. By using multiple sources, the researchers could fill in gaps. Only a few of Switzerland’s glaciers have been studied regularly over the years.

The research involved using decades-old techniques to allow for comparisons of the shape and position of images of terrain, and the use of cameras and instruments to measure angles of land areas. The teams compared surface topography of glaciers at different moments, allowing for calculations about the evolution in ice volumes.

Not all Swiss glaciers have been losing ice at the same rates, the researchers said. Altitude, amounts of debris on the glaciers, and the flatness of a glacier’s “snout” — its lowest part, which is the most vulnerable to melting — all affect the speeds of ice retreat.

The researchers also found that two periods — in the 1920s and the 1980s — actually experienced sporadic growth in glacier mass, but that was overshadowed by the broader trend of decline.

The findings could have broad implications for Switzerland’s long-term energy sources, since hydropower produces nearly 60 percent of the country’s electricity, according to government data.

____________

- NASA Studies Find Previously Unknown Loss of Antarctic Ice

The greatest uncertainty in forecasting global sea level rise is how Antarctica’s ice loss will accelerate as the climate warms. Two studies published Aug. 10 and led by researchers at NASA’s Jet Propulsion Laboratory in Southern California reveal unexpected new data about how the Antarctic Ice Sheet has been losing mass in recent decades.

One study, published in the journal Nature, maps how iceberg calving – the breaking off of ice from a glacier front – has changed the Antarctic coastline over the last 25 years. The researchers found that the edge of the ice sheet has been shedding icebergs faster than the ice can be replaced. This surprise finding doubles previous estimates of ice loss from Antarctic’s floating ice shelves since 1997, from 6 trillion to 12 trillion metric tons. Ice loss from calving has weakened the ice shelves and allowed Antarctic glaciers to flow more rapidly to the ocean, accelerating the rate of global sea level rise.

The other study, published in Earth System Science Data, shows in unprecedented detail how the thinning of Antarctic ice as ocean water melts it has spread from the continent’s outward edges into its interior, almost doubling in the western parts of the ice sheet over the past decade. Combined, the complementary reports give the most complete view yet of how the frozen continent is changing.

Mapping 36 Years of Ice Loss

In the complementary study, JPL scientists have combined almost 3 billion data points from seven spaceborne altimetry instruments to produce the longest continuous data set on the changing height of the ice sheet – an indicator of ice loss – from as early as 1985. They used radar and laser measurements of ice elevation, accurate to within centimeters, to produce the highest-resolution monthly maps of change ever made of ice loss.

The unparalleled detail in the new record reveals how long-term trends and annual weather patterns affect the ice. It even shows the rise and fall of the ice sheet as subglacial lakes regularlyfill and empty miles below the surface. “Subtle changes like these, in combination with improved understanding of long-term trends from this data set, will help researchers understand the processes that influence ice loss, leading to improved future estimates of sea level rise,” said JPL’s Johan Nilsson, lead author of the study.

Synthesizing and analyzing the massive archives of measurements into a single, high-resolution data set took years of work and thousands of hours of computing time on NASA’s servers. Nilsson says it was all worth it: “Condensing the data into something more widely useful may bring us closer to the big breakthroughs we need to better understand our planet and to help prepare us for the future impacts of climate change.”

https://climate.nasa.gov/news/3206/n...antarctic-ice/

_____________

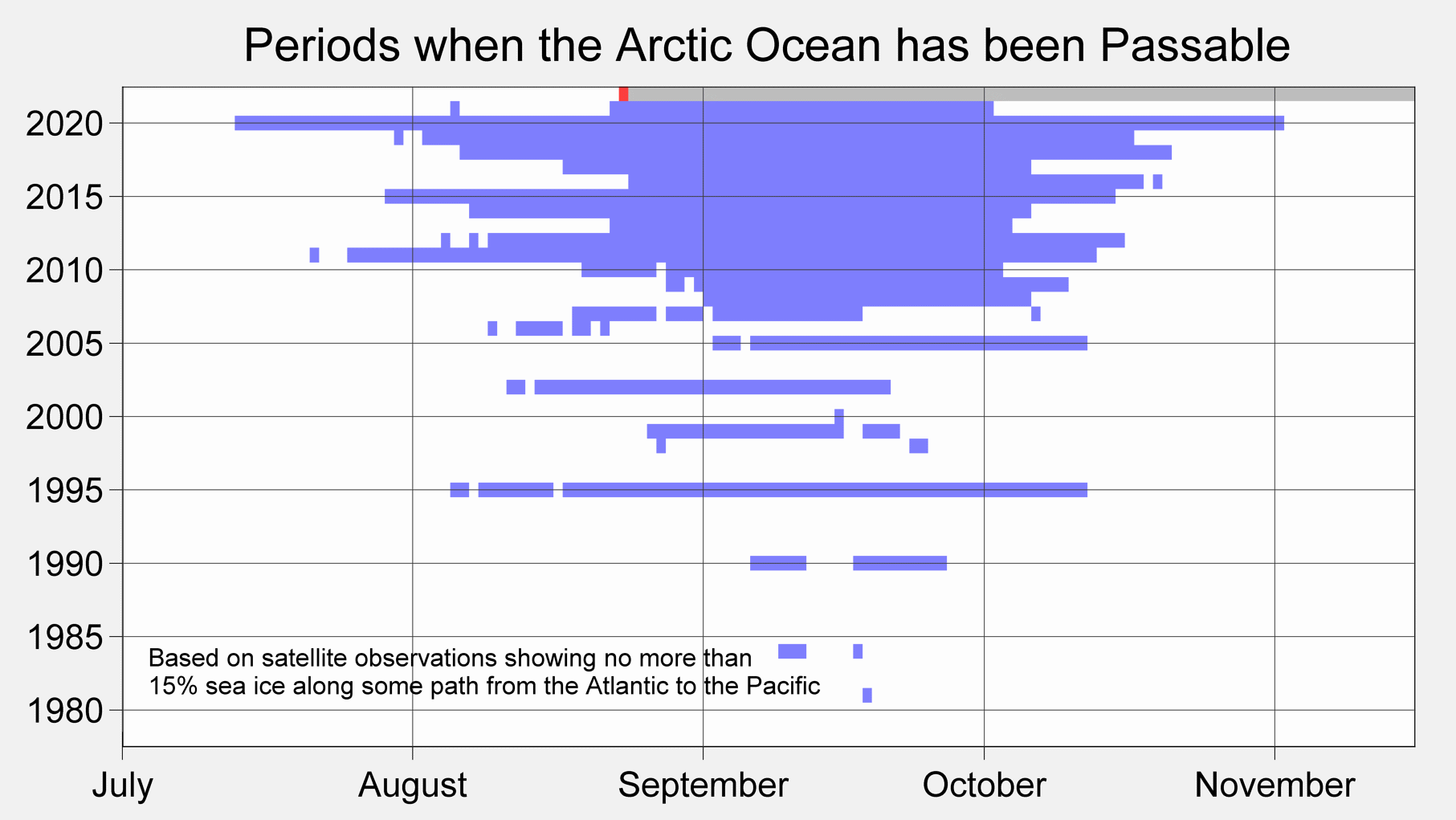

Dr. Robert Rohde - Retreating Arctic sea ice has reopened the Northern Sea Route through the Arctic Ocean for the 2022 season.

This date is similar to 2021, but much later than the 2020 record.

As a reminder, prior to 2005, most years never had a full open water passage through the Arctic. https://twitter.com/RARohde/status/1562477619932987392

_____________

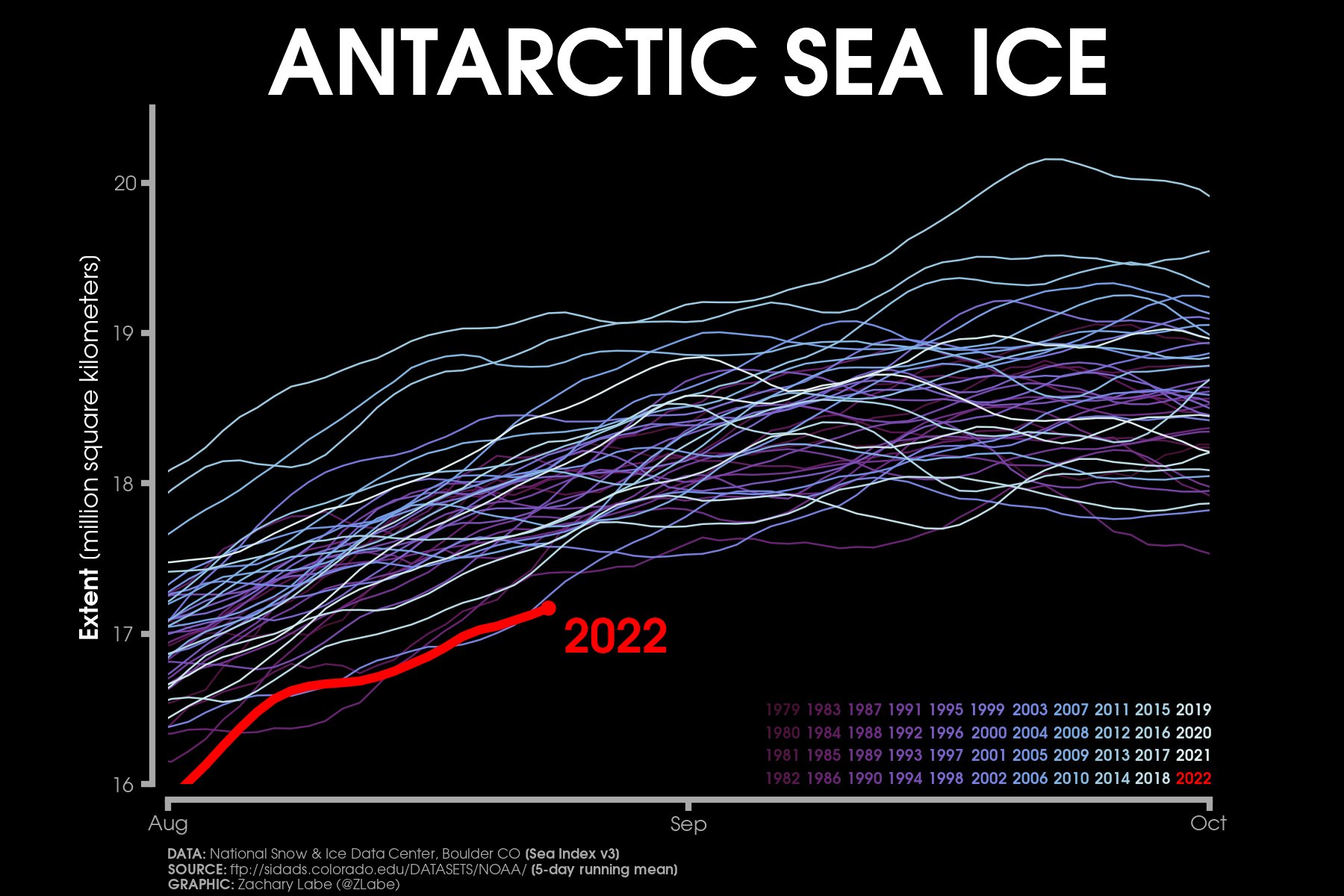

Zack Labe - I'll be keeping a close eye on #Antarctic sea ice extent over the next few weeks as we approach the annual maximum. Current levels are a record low. And earlier this year, Antarctic sea ice set a new all-time record low annual minimum. https://twitter.com/ZLabe/status/1562402124365201409

ANTARCTIC: SEA-ICE CONCENTRATION/EXTENT: https://zacklabe.com/antarctic-sea-i...concentration/

____________

- BlackRock, UBS and 348 ESG funds "banned" in Texas

Wall Street giants have a Texas-sized problem: making good on flashy vows to make clients' investments greener while limiting political and financial blowback from red states.

Catch up fast: On Wednesday, Texas Republican Comptroller Glenn Hegar released a list of 10 companies and 348 investment funds that will be barred from doing business with the state because they “boycott energy companies.”

- The list follows enactment of a law last year prohibiting most state agencies and local governments from contracting with such firms.

- BlackRock, Credit Suisse and UBS made the banned list, along with sustainable investment funds from other banks.

Why it matters: At stake are trillions in investments — including by state pension funds as well as individuals’ retirement savings — and the future of the fossil fuel industry that is fueling global warming.

The intrigue: Consumers and regulatory agencies are pushing investment firms like BlackRock to take climate-related risks into account when making money management decisions.

- This is occurring as the impacts of global warming become more apparent and severe — such as with the extreme rainfall event this week in Dallas.

- At the same time, however, red state politicians have been railing against so-called “woke capitalism,” assailing environmental, social and corporate governance (ESG) funds in particular.

What they're saying: “The environmental, social and corporate governance (ESG) movement has produced an opaque and perverse system in which some financial companies no longer make decisions in the best interest of their shareholders or their clients, but instead use their financial clout to push a social and political agenda shrouded in secrecy,” Hegar said in a statement.

Yes, but: The 10 companies banned from doing business with the Texas government do have considerable fossil fuel investments. BlackRock wrote a letter to Hegar in May stating it actively invests in the energy industry.

- The firm is a large shareholder in ConocoPhilips and Exxon Mobil, Bloomberg reported.

- “This is not a fact-based judgment. BlackRock does not boycott fossil fuels — investing over $100 billion in Texas energy companies on behalf of our clients proves that,” BlackRock spokesman Brian Beades told Axios on Wednesday.

- UBS also criticized Texas’ action. "We provided their office with extensive information on our policies and practices, demonstrating that UBS does not boycott energy companies even under a broad interpretation of Texas law," spokesperson Erica Chase told Axios Austin’s Asher Price.

Between the lines: Though it would apply to large funds such as the Teacher Retirement System, the banned list is unlikely to have much of an impact on Wall Street, according to Daniel Firger, managing director of Great Circle Capital Advisors, a climate finance consultancy.

- The holdings of Texas' funds covered under the ban are far lower than those from states like California and New York, which have moved aggressively to limit their fossil fuel exposure, Firger told Axios.

Context: The Texas action is not an isolated development. Late last month, West Virginia barred five major financial firms, including BlackRock and JPMorgan Chase, from new state business after concluding they were boycotting the fossil fuel industry.

- Other Republican-led, energy producing states may follow suit, creating stronger headwinds for sustainable investing.

The bottom line: "Long term, climate change is not going anywhere. And so the capital markets are going to have to deal with that fact, and at root, I think that's what this ESG fight is all about," Firger said.

https://www.axios.com/2022/08/25/tex...s-esg-backlash

__________

- US Interior grants $560 million across 24 states to plug more than 10,000 orphaned wells

The Department of the Interior on Thursday announced a $560 million grant to 24 states to start plugging up and reclaiming abandoned oil and gas wells.

The Interior department estimates there are more than 10,000 of the so-called orphan wells across those 24 states that leak methane, significantly polluting communities and recreation spaces and contributing to climate change.

The funding to plug up the wells comes from President Biden’s historic infrastructure package passed last year. The law includes $4.7 billion specifically to address the orphan wells. Thursday’s funding is part of a phase one investment of $1.15 billion.

Interior Secretary Deb Haaland said the infrastructure law “is enabling us to confront long-standing environmental injustices by making a historic investment to plug orphaned wells throughout the country.”

“At the Department of the Interior, we are working on multiple fronts to clean up these sites as quickly as we can by investing in efforts on federal lands and partnering with states and Tribes to leave no community behind,” Haaland said in a statement.

Interior officials say there are more than 129,000 abandoned oil and gas wells across the country, so the effort to plug them up in 24 states is just one step in the Biden administration’s larger goal of halting those methane leaks on the continental U.S.

Some of those 24 states have a large number of orphan wells. Kentucky, for example, is estimated to have up to 1,200 of them, while Kansas has more than 2,300 wells and Oklahoma has about 1,196.

As part of Thursday’s grant, six states, including California, Mississippi and West Virginia, will begin measuring methane emissions at wells they plug up and remediate.

Twelve states, including Kansas, New Mexico and Ohio, will prioritize plugging up wells in disadvantaged communities.

The Department of the Interior announced the phase one investment in January, the same month officials warned the U.S. has double the amount of abandoned oil and gas wells than previously thought.

The Biden administration has focused much of its attention on tackling climate change, including through the passage of the Inflation Reduction Act this month, which has allocated $369 billion for clean energy projects.

Methane is 25 times more potent than carbon dioxide at trapping heat in the atmosphere and significantly accelerates climate change once released.

https://thehill.com/policy/energy-en...rphaned-wells/

___________

- US Climate law could reduce costs associated with emissions up to $1.9 trillion: OMB

The Inflation Reduction Act, the tax and climate bill President Biden signed into law last week, could reduce the costs from climate-related damages by up to $1.9 trillion, according to an analysis by the Office of Management and Budget (OMB).

The analysis published Tuesday is based on three models crafted by Rhodium Group and Princeton University. They found the law’s climate provisions could potentially cut up to 1 billion annual metric tons of carbon dioxide by the end of the decade, nearly meeting the White House target of cutting emissions in half relative to 2005 by 2030.

To model the reductions beyond 2030, the analysis uses the “social cost of carbon” metric, or the financial damages associated with a projected future level of carbon pollution. The analysis notes that the model assumes yearly reductions through 2030 will continue at a comparable pace through the next two decades, which is likely a conservative estimate.

Meeting these projections could reduce financial damages from climate impacts by between $700 billion and $1.9 trillion up to 2050, the OMB models found. In addition to reduced property damage from climate disaster, the savings would also come in the form of fewer negative health impacts and fewer energy costs associated with hotter temperatures.

In the nearer term, the models project the law could save between $34 billion and $84 billion a year by 2030.

The analysis, first shared with Axios, notes that the projections are entirely theoretical and do not account for every eventuality that may be involved in implementing the complex law.

“Implementing the Inflation Reduction Act will come with a set of challenges, and real-world [greenhouse gas] emissions reductions will be impacted by complicated economic interactions,” the report states. It also notes that the social cost of carbon estimates are likely low “because they do not account for many important climate damage categories, such as ocean acidification, and because of such omitted damages and other limitations and assumptions.”

However, OMB added, the numbers do not include any potential benefits to other parts of the economy, which could produce further reductions in emissions.

https://thehill.com/policy/energy-en...-trillion-omb/

Results 1 to 25 of 6895

Thread: Any doubts about Climate Change?

Threaded View

-

27-08-2022, 07:19 PM #10

Last edited by S Landreth; 27-08-2022 at 07:25 PM.

Thread Information

Users Browsing this Thread

There are currently 73 users browsing this thread. (0 members and 73 guests)

Reply With Quote

Reply With Quote