^Water is the new gold.

Results 76 to 97 of 97

Thread: EU Future

-

09-06-2012, 03:58 PM #76Banned

- Join Date

- Jun 2011

- Last Online

- 14-08-2015 @ 05:39 PM

- Location

- Ex-Pat Refugee in Thailand

- Posts

- 9,579

-

09-06-2012, 07:24 PM #77Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Yesterday @ 06:56 PM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,257

I agree that water is the resource you cannot live without. However private ownership is an impossibility for the masses.

-

21-06-2012, 07:30 AM #78

A trader gives an interview to BBC. It's less the 2 minutes.

Do you agree with him? Millions of people will lose their savings. Less than 1 year. The EU situation is like a growing cancer tumor.

............

-

21-06-2012, 01:03 PM #79In transit to Valhalla

- Join Date

- Oct 2008

- Last Online

- @

- Posts

- 5,036

^

Pretty scary, but very very true, this young man and the organizations he work for is the cancer, the economic crisis is created by them and the present Eurozone crisis is kept alive not by the numbers but by market sentiment manipulation, many have already gambled on a collapse and they will do all in their power to see it through, media manipulation and so forth, because if it does not happen they stand to loose big time.

It is very evident, no matter what sensible solutions, aid packets in billions, bank packets, austerity, cutting back on government expenses, the market react negatively - why...... because they have already made their bets, nothing short of Obamaesk Euro infusions of new multiple trillions of un-financed debts into the financial markets for them to get rich on and play with will see them satisfied. The un-financed stimulous they constantly push and ask for will not make jobs but end in their pockets, austerity as in - do not spend more money than you have coming in - have in this fourth dimension financial circus world suddenly become wrong, fuck them I say do not listen but send bailiffs to shut down their offices, money is made by workers in factories, farmers on their land, producing goods that will sell, money is not made in offices on computers as they have made us believe, and the world will survive just fine without them.

Governments and the normal citizens of those Governments are at war with global private finance, and it is scary that those Governments are not waking up, what is needed is strong law intervention on financial speculation tools.

This Guy reminds me of the Enron traders, "burn baby burn" they have no morals, no country affiliation, only one God and that is money, and never mind how they get their hands on them.

-

21-06-2012, 07:17 PM #80Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Yesterday @ 06:56 PM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,257

The video is from December last year. The supposedly people in control have continued in profiting from the fear. The politicians have constantly failed to act to remedy any of the problems.

For a trader to stand up and admit that there are ways of making money from "the markets" is nothing new.

Don't blame the messengers. For a trade to take place there must be a seller and a buyer. A farmer takes out a forward contract to ensure a price maybe months from now. A trader accepts that contract based on his/her judgement. Sometimes the trader wins, sometimes the farmer wins. It's the same with widgets from a factory. To portray that money or values is only added at the most basic/manual level is too simplistic.

If you are a fruit fly then yes waiting for evolution to design, by chance, a better fruit fly may be sufficient for the species. The human race has evolved and cannot sit/fly around waiting for chance to improve their situation.

There may well be people trying desperately to stop Armageddon. What I see is politicians constantly goading other countries, financially, morally and with armed force. They all need to look closer to home and solve their own problems not create some more in far flung countryA tray full of GOLD is not worth a moment in time.

-

21-06-2012, 07:20 PM #81Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Yesterday @ 06:56 PM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,257

It's the law of the jungle, instead of killing physically it's killing financially or as some call it capitalism. Originally Posted by larvidchr

Originally Posted by larvidchr

-

22-06-2012, 09:08 AM #82

We all know that Greece has already borrowed so much - including interest of course that it will never pay it back.

Recent general article (again) from a periodical (wsj)

We all know, and have known, that the Euro is in the last stages of life.

Gerald O'Driscoll: How the Euro Will End - WSJ.com

-

22-06-2012, 11:56 AM #83loob lor geezer

- Join Date

- Feb 2009

- Last Online

- 02-05-2019 @ 08:05 AM

- Location

- The land of silk and money.

- Posts

- 5,984

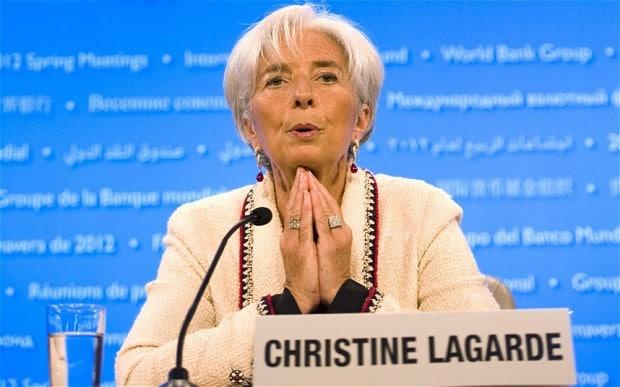

IMF unveils its blueprint to salvage the stricken euro

The International Monetary Fund has directly confronted Germany by urging the eurozone to take a "determined and forceful move" to "complete economic and monetary union" by sharing government debt and underwriting failing banks.

Christine Lagarde, the IMF's managing director, last night unveiled the blueprint to save the euro while warning that the EU's single currency was under "acute stress" that threatened "the viability of the monetary union itself". Photo: EPA

Christine Lagarde, the IMF's managing director, last night unveiled the blueprint to save the euro while warning that the EU's single currency was under "acute stress" that threatened "the viability of the monetary union itself". Photo: EPA

By Bruno Waterfield, in Luxembourg

11:55PM BST 21 Jun 2012

The IMF's intervention is timed to tip the balance against Angela Merkel at a critical summit between Germany, France, Italy and Spain in Rome today where the embattled German Chancellor will be fighting off identical demands.

Christine Lagarde, the IMF's managing director, last night unveiled the blueprint to save the euro while warning that the EU's single currency was under "acute stress" that threatened "the viability of the monetary union itself".

"We are clearly seeing additional tension and acute stress applying to both banks and sovereigns in the euro area," she said.

"With that in mind, the IMF believes that a determined and forceful move towards complete European monetary union should be reaffirmed in order to restore faith in the system, because we see at the moment the viability of the European monetary system is questioned."

Germany is opposed to almost every single element of the IMF measures, including "common debt", a European deposit guarantee scheme, a single banking resolution fund, sovereign bond purchases by the European Central Bank and direct aid by euro bail-out funds to struggling financial institutions.

The eurozone last night looked set to afford Greece more time to implement austerity measures but the embattled country's new government suffered a hostile reaction to its plea for fewer public sector job losses and cuts to welfare benefits.

Eurozone finance ministers in Luxembourg announced that the "troika" of officials from the European Central Bank, European Commission and IMF would be back in Athens next Monday after the elections last weekend.

The new government, a fragile coalition that faces a strong far-Left opposition, has asked the EU for an extra two years to hit austerity targets set as part of the country's €240bn (£193bn) bail-out.

Eurozone finance ministers, relieved that a pro-bail-out Greek government has been formed, thus saving the single currency from almost certain break-up, are sympathetic to giving Greece more time.

But a Greek request for an extra €16bn to €20bn in aid to help reduce 150,000 civil service job losses and minimum wage and pension cuts met with a hostile reception.

IMF unveils its blueprint to salvage the stricken euro - Telegraph

-

22-06-2012, 12:04 PM #84The International Monetary Fund has directly confronted Germany by urging the eurozone to take a "determined and forceful move" to "complete economic and monetary union" by sharing government debt and underwriting failing banks.Isn't this just postponing the inevitable? By sharing gov debt and underwriting failing banks, it's like plugging 5 out of ten holes in a ship that is filling with water."We are clearly seeing additional tension and acute stress applying to both banks and sovereigns in the euro area," she said.

IMO, the EZ/UE includes nations that should not have been let in.

The recent talk of course is about Greece. But (from the WSJ article I put a link to above) Spain's economy is much much bigger and more interconnected that Greece's.

If and when Spain hits the wall there will be very serious consequences, and the Euro will be finished.

-

23-06-2012, 06:03 PM #85loob lor geezer

- Join Date

- Feb 2009

- Last Online

- 02-05-2019 @ 08:05 AM

- Location

- The land of silk and money.

- Posts

- 5,984

Debt crisis: Angela Merkel defies Latin Europe and the IMF on bond rescue

German Chancellor Angela Merkel has shot down calls for full mobilisation of the eurozone's bail-out funds to halt the raging bond crisis in Spain and Italy, ignoring unprecedented pleas for action from the International Monetary Fund.

Mrs Merkel -- or La Signora No in Italy -- doused hopes of a break-through on proposals by the "Latin Bloc" leaders of Italy, France, and Spain to deploy the funds (EFSF and ESM) to cap the bond yields of "virtuous" countries vulnerable to contagion, or to recapitalize banks directly to take the strain off sovereign states. Photo: EPA

Mrs Merkel -- or La Signora No in Italy -- doused hopes of a break-through on proposals by the "Latin Bloc" leaders of Italy, France, and Spain to deploy the funds (EFSF and ESM) to cap the bond yields of "virtuous" countries vulnerable to contagion, or to recapitalize banks directly to take the strain off sovereign states. Photo: EPA

By Ambrose Evans-Pritchard, in Rome

8:07PM BST 22 Jun 2012

"Each country wants to help but if I am going to call on taxpayers in Germany, I must have guarantees that all is under control. Responsibility and control go hand in hand," she said after a crucial summit of the eurozone's Big Four powers in Rome.

Mrs Merkel -- or La Signora No in Italy -- doused hopes of a break-through on proposals by the "Latin Bloc" leaders of Italy, France, and Spain to deploy the funds (EFSF and ESM) to cap the bond yields of "virtuous" countries vulnerable to contagion, or to recapitalize banks directly to take the strain off sovereign states.

"If I give moneystriaght to Spanish banks, I can't control what they do. That is how the treaties are written," she said, before racing off to Danzig to tonight for Euro 2012 quarter final between Greece and German..

Christine Lagarde, the head of the IMF, warned before the summit that the eurozone is under "acute stress" and at risk of a downward spiral.

"The viability of the European monetary system is questioned. There must be a recapitalisation of the weak banks, with preferably a direct link between the EFSF/ESM and the banks, in order to break the negative feedback loop that we have between banks and sovereigns."

She called on the European Central Bank to back-stop the financial system with "creative and inventive" measures to fight the crisis.

Italy's premier Mario Monti put the best face on events, insisting that the Big Four leaders had come together at the birth place of the European Project to do whatever it takes to shore up monetary union.

"The euro is here to stay and we all mean it," he said, switching from Italian into English to send an emphatic message to markets and Anglo-Saxon world.

For all the rhetoric at Rome's Villa Madama -- a Rennaissance retreat of the Medici family designed by Raphael -- the trio of Latin leaders seemingly failed to shift German Merkel one inch in the direction of debt pooling or genuine fiscal union.

The contrast between pro-forma talk of "more Europe" in the Roman hills and the festering reality on the ground in austerity Europe was not lost on those at the summit. Across the Tiber, much of Rome was paralysed by a bus and metro strike, evidence of the growing resitance to the harsh fiscal squeeze imposed by Mr Monti's technocrat government.

French president Francois Hollande did not hide his frustration, warning that France would not accede to German demands for a step-change in EU integration until Berlin puts the neuraligic issue of shared debts on the table. "There will be no transfer of sovereignty without greater solidarity, " he said acidly.

The Latin Bloc's soft diplomacy has essentially failed. Europe's key leaders will converge on Brussels for next week's crucial summit as divided as ever on the great issue of the day.

The leaders were left offering the thin gruel of infrastructure projects and long-term investment worth €130bn or 1pc of eurozone GDP, financed by leveraging an extra €10bn of base capital at the European Investment Bank.

Critics say this type of spending will take years to bear fruit and and will do little to halt the insidious process of debt-deflation already at work across much of Southern Europe. "This pact has a `shuffling of the deckchairs' feel to it," said Nicholas Spiro from Spiro Sovereign Strategy.

The four leaders agreed to press ahead with a financial transaction tax to "fight speculation" but it will for now be confined to an advance guard of EMU states, leaving the UK happily outside.

Observers were baffled by the summit optimism of Spanish leader Mariano Rajoy, who said he was "enormously pleased" by progress towards an EMU banking and fiscal union

"There was a powerful committment between all of us to use all necessary means to restore financial stability in the euro zone. The EFSF can buy bonds on the secondary market. It is an objective fact," he said.

Diplomats say Germany may have softened its stance slightly on terms for Spain's €100bn rescue from the eurozone to shore up its banks, due to be activated on Monday.

The EFSF/ESM machinery can be used to cap bond yields, yet Germany is sticking to its position that any use must be activated by a formal request according to EU rules -- entailing draconian controls. There is no sign she is willing to drop her vehement opposition to banking licence for the funds enabling them to draw on the full firepower of the ECB.

Italian officials say Mrs Merkel is hiding behind legal technicalities. The EU Treaties restrict the ability of ECB to act as lender of last resort for governments, but it clearly does have the power to launch quantitative easing -- if need be -- to the ensure financial stability and prevent further contraction of the eurozone money supply. The obstacle is entirely political.

"The Germans are blackmailing the ECB," said one official. "They have more or less threatened to withdraw from the euro if the ECB puts one foot out of line."

The Bundesbank openly criticized the ECB's decision on Friday to relax collateral rules for banks, a move that offers a lifeline to Spanish and Italian lenders running out of assets that can be pledged at the ECB's liquidity window. "The Bundesbank is critical," said a spokesman.

Professor Charles Wyplosz from Geneva University said the entire crisis strategy imposed by Germany since May 2010 had been a "disaster" and risks setting off a chain of sovereign defaults that may bankrupt Germany itself.

"From the very start, it was clear that a domino game was under way. The solution will have to combine debt structuring and ECB lending in last resort to banks and governments. Angela Merkel needs now to lift the German veto," he said.

Debt crisis: Angela Merkel defies Latin Europe and the IMF on bond rescue - Telegraph

-

23-06-2012, 06:06 PM #86loob lor geezer

- Join Date

- Feb 2009

- Last Online

- 02-05-2019 @ 08:05 AM

- Location

- The land of silk and money.

- Posts

- 5,984

^ Surely there can't be many people that are surprised by Merkels decision so they shouldn't be feeling too disappointed.

-

23-06-2012, 09:35 PM #87

Here is a brief summary and response by Max Keiser on the recent Moody's downgrade of 15 large banks. Most banks are in Europe.

!

-

24-06-2012, 12:24 AM #88Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Yesterday @ 06:56 PM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,257

An "expert" eh, an entertainer yes, but has he any palatable solutions?

-

24-06-2012, 07:22 AM #89

Wouldn't matter if he gave his "proposed solutions."

They will not happen. That is for the policy-makers. Look at where they have taken us?

The point of the piece is his comment that the "banks are dead."

Agree? Disagree?

If you look at at the numbers borrowed by Greece + interest, and the other issues of the ECB, the banks are.....dead.

-

24-06-2012, 07:37 PM #90Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Yesterday @ 06:56 PM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,257

Most of the "banks" debt has been conveniently passed on to the local taxpayers. If the debts had stayed with the politicians and banks the Greek population would not now be starving, would be receiving medical attention........ Originally Posted by barbaro

Originally Posted by barbaro

Look at the politicians bank accounts, look at the fees the banks generated for "advising" the financially inept governments

That is what Max and Stacy highlight with sometimes theatrical performances.

-

24-06-2012, 08:06 PM #91

Tony Blair: UK may face 'interesting choice' over euro

Tony Blair has said the UK will face an "interesting choice" over whether to join the euro if the currency's current crisis is resolved.

The former prime minister told the BBC he believed the UK should still be keeping open the option of joining it.

He said that looking at the "broad sweep of history" in the long term "the European integration project" was going to go ahead, "like it or not". (Democracy in action again eh Tony?)

The UK, as a "small island nation", had to be part of it to have influence.

Mr Blair said that the only thing that would save the single currency now was to have a "grand plan" where Germany was ready to commit its economy fully - "treating the debts of one as the debts of all".

www.bbc.co.uk

As a committed man of Europe should we be surprised at Blairs suggestion that whilst the EU is struggling to come to terms with it's own unity he mentions that european intergration will be thrust upon the nation despite the people's current grave concerns?Last edited by Mr Lick; 24-06-2012 at 09:18 PM.

-

24-06-2012, 08:09 PM #92

Greek coalition proposes easing bailout terms

Greece's new coalition government has proposed an extension to the deadline for it to reduce its budget deficit by at least two years, to 2016.

In a policy document, the government said its aim was for the fiscal target envisaged by the bailout deal to be met without further cuts to salaries and pensions.

Greece is under huge international pressure to fulfil bailout terms.

Polls last week ended a two-month deadlock over its implementation.

Pro-bailout parties gained a narrow majority in parliament, despite widespread public anger at austerity measures stipulated in the bailout

www.bbc.co.uk

The Greek president has undergone an eye operation over the weekend and will therefore not be attending the EU crisis summit. The Greek Finance Minister who has suffered a fainting spell in recent days will also be missing- who can blame them eh?Last edited by Mr Lick; 24-06-2012 at 09:35 PM.

-

05-07-2012, 02:53 PM #93

Viva L'France....not so fast. Spain may be the next and biggest shoe to drop....and now we have France entering into the picture.....

Entire: News HeadlinesFrance Faces Major Test as It Enters 'Danger Zone'

Published: Tuesday, 3 Jul 2012

By: Patrick Allen

CNBC EMEA Head of News

Having been in power for less than two months Francois Hollande is facing the first major test of his pro-growth election commitments after a warning from the national audit office that France’s economy is in the “danger zone” and risks falling into a “debt spiral.”

Late on Monday the national audit office said the French budget deficit will overshoot by 6-10 billion euros ($7.56-12.6 billion) this year and by 33 billion euros in 2013. In order to bring the budget in-line with EU rules, Hollande is going to have to make difficult decisions on spending and taxes that could draw criticism from his own party and unions who supported the pro-growth message that saw him beat Nicolas Sarkozy to the presidency in May.

"The country is in the danger zone in terms of its economy and public finances. We cannot rule out the possibility of a debt spiral," Didier Migaud, head of the Court of Auditors said in a news conference reported by Reuters. "2013 is a crucial year. The budgetary equation is going to be very hard, much harder than expected due to the worsening of the economic picture."

-

05-07-2012, 03:53 PM #94

-

20-07-2012, 08:48 PM #95

IMF's Peter Doyle scorns its 'tainted' leadership

A top economist at the International Monetary Fund has poured scorn on its "tainted" leadership and said he is "ashamed" to have worked there.

Peter Doyle said in a letter to the IMF executive board that he wanted to explain his resignation after 20 years.

He writes of "incompetence", "failings" and "disastrous" appointments for the IMF's managing director, stretching back 10 years.

No one from the Washington-based IMF was immediately available for comment.

Mr Doyle, former adviser to the IMF's European Department, which is running the bailout programs for Greece, Portugal and Ireland, said the Fund's delay in warning about the urgency of the global financial crisis was a failure of the "first order".

In the letter, dated 18 June and obtained by the US broadcaster CNN, Mr Doyle said the failings of IMF surveillance of the financial crisis "are, if anything, becoming more deeply entrenched".

He writes: "This fact is most clear in regard to appointments for managing director which, over the past decade, have all-too-evidently been disastrous.

"Even the current incumbent [Christine Lagarde] is tainted, as neither her gender, integrity, or elan can make up for the fundamental illegitimacy of the selection process."

Mr Doyle is thought to be echoing here widespread criticism that the head of the IMF is always a European, while the World Bank chief is always a US appointee.

Mr Doyle concludes his letter: "There are good salty people here. But this one is moving on. You might want to take care not to lose the others."

.................................................. .................................................. .....

Interesting that a senior and very experienced member of the IMF is now calling the organsation a shambles. On an earlier post i mentioned that Christine Largarde was a failed French finance minister and Mr Doyle appears to agree that her selection as IMF leader was less than appropriate.

Of course working in the finance world and making many friends at the expense of the taxpayer appears to be qualification most admired by those who enjoy a few G & T's at lunchtime so no matter how little talent one possesses one is always guaranteed a nice little number in ones autumn years from the union of backscratchers.

-

20-07-2012, 10:34 PM #96Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Yesterday @ 06:56 PM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,257

Before boarding a plane to head up the PBOC in Beijing. Originally Posted by Mr Lick

Originally Posted by Mr Lick

-

20-07-2012, 10:35 PM #97

Spain: Eurozone deal fails to ease concerns

Spain has seen a week of demonstrations against austerity cuts

Spain's financial woes have deepened despite eurozone finance ministers approving a deal to lend up to 100bn euros (£78bn) to bolster its banks.

The heavily-indebted Valencia region requested an undisclosed loan from a new rescue fund set up last Friday.

And the yield on Spanish 10-year bonds shot up a quarter percentage point to 7.28%, a rate regarded by analysts as unsustainable in the long run.

Meanwhile, Spain's Ibex stock index tumbled almost 6% .

The eurozone ministers agreed the loan in return for Spain restructuring and improving the governance and regulation of its banking sector.

But the exact size of the loan will probably only be disclosed in September, when Spain's government gets the results of an audit of its banks.

The International Monetary Fund welcomed the finance ministers' decision to grant financial assistance, saying the measures would help to "significantly strengthen Spain's financial system, an essential step in restoring growth and prosperity in the country".

.................................................. ................

Strange that one or two other prominent leaders around the globe have agreed that one cannot borrow oneself out of debt.

The IMF again, appear to be throwing good money after bad in an effort to maintain unity within the EU and i'm not sure in the current climate with constant street protests and high unemployment figures in Spain how this can possibly be achieved.

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Reply With Quote

Reply With Quote