Divide and rule...

Results 51 to 70 of 70

-

25-04-2008, 01:00 PM #51Thailand Expat

- Join Date

- Oct 2006

- Last Online

- 08-12-2011 @ 06:20 PM

- Location

- West Coast Canada

- Posts

- 2,908

-

25-04-2008, 01:01 PM #52I am in Jail

- Join Date

- Apr 2007

- Last Online

- 22-11-2011 @ 08:27 AM

- Location

- Christian Country

- Posts

- 15,017

^ No sh*t.

-

25-04-2008, 02:01 PM #53

Here's an article from the Wall St. Journal. A little Yank centric, but also worldwide, and Asia is noted. He's a manager of a fund.

Entire: R.O.I. - WSJ.comLoad Up the Pantry

April 21, 2008

I don't want to alarm anybody, but maybe it's time for Americans to start stockpiling food.

No, this is not a drill.

You've seen the TV footage of food riots in parts of the developing world. Yes, they're a long way away from the U.S. But most foodstuffs operate in a global market. When the cost of wheat soars in Asia, it will do the same here.

....And some prices are rising even more quickly. The latest data show cereal prices rising by more than 8% a year. Both flour and rice are up more than 13%. Milk, cheese, bananas and even peanut butter: They're all up by more than 10%. Eggs have rocketed up 30% in a year. Ground beef prices are up 4.8% and chicken by 5.4%.

These are trends that have been in place for some time.

And if you are hoping they will pass, here's the bad news: They may actually accelerate.

-

25-04-2008, 02:09 PM #54I am in Jail

- Join Date

- Apr 2007

- Last Online

- 22-11-2011 @ 08:27 AM

- Location

- Christian Country

- Posts

- 15,017

Wheat costs in Asia? A bit off the mark when most everyone in Asia eats rice. Maybe if he said "staple foods" I'd be more inclined to listen to this. Still, I have seen near riots in Vancouver when the water sources were unpotable and folks were fighting for bottled water in the shops. Doesn't take much to foment a frenzied scare.

-

26-04-2008, 08:29 PM #55I am in Jail

- Join Date

- Aug 2007

- Last Online

- 15-12-2012 @ 03:35 PM

- Posts

- 5,908

Meanwhile, is this leading to hysteria in the US and elsewhere or good common sense?

Load Up the Pantry (Larder)

I don't want to alarm anybody, but maybe it's time for Americans to start stockpiling food.

No, this is not a drill.

You've seen the TV footage of food riots in parts of the developing world. Yes, they're a long way away from the U.S. But most foodstuffs operate in a global market. When the cost of wheat soars in Asia, it will do the same here.

Reality: Food prices are already rising here much faster than the returns you are likely to get from keeping your money in a bank or money-market fund. And there are very good reasons to believe prices on the shelves are about to start rising a lot faster.

"Load up the pantry," says Manu Daftary, one of Wall Street's top investors and the manager of the Quaker Strategic Growth mutual fund. "I think prices are going higher. People are too complacent. They think it isn't going to happen here. But I don't know how the food companies can absorb higher costs." (Full disclosure: I am an investor in Quaker Strategic)These are trends that have been in place for some time.

And if you are hoping they will pass, here's the bad news: They may actually accelerate.

The reason? The prices of many underlying raw materials have risen much more quickly still. Wheat prices, for example, have roughly tripled in the past three years.

Sooner or later, the food companies are going to have to pass those costs on. Kraft saw its raw material costs soar by about $1.25 billion last year, squeezing profit margins. The company recently warned that higher prices are here to stay. Last month the chief executive of General Mills, Kendall Powell, made a similar point.Load-Up-the-Pantry: Personal Finance News from Yahoo! FinanceThe main reason for rising prices, of course, is the surge in demand from China and India. Hundreds of millions of people are joining the middle class each year, and that means they want to eat more and better food.

-

23-01-2011, 05:48 AM #56

Need to tackle food price rises

22/01/2011

Agriculture ministers from Europe, Africa and Canada warned Saturday of dire consequences, including riots and social unrest, unless action is swiftly taken to improve food security and tackle price hikes.

The ministers from Germany, France, Poland, Ukraine, Morocco, Kenya and Canada met in Berlin to prepare for a larger gathering which was to begin later in the day.

The seven agriculture ministers were unanimous on the causes and consequences of food shortages, which are pushing prices sharply up and, they agreed, renewing the threats of social instability and the sort of food riots witnessed in Mozambique, Egypt and elsewhere last year.

``We will see them again in 2011 and 2012 if we don't rapid take the necessary decisions together,'' warned French minister Bruno Le Maire.

His Moroccan counterpart Aziz Akhenouch denounced the ``rocketing prices'' which threaten purchasing power as well as political stability in his country, which is a major wheat importer and saw prices double last year.

There was apparently broad agreement, at the Green Week meeting in the German capital, on some steps to tackle the problems; increased production with help from higher yields, and trade stimulation while fighting against the speculators who ramp up the market.

``It is important to open borders,'' for certain products, stressed Kenyan farm minister Sally Jepngetich Kosgey.

``Trade is part of the solution, not the problem,'' said Pascal Lamy, the World Trade Organisation's director general, who also attended the meeting.

However there were sharp differences on the questions of further opening borders for agriculture products.

``Everyone wants first and foremost to support their own infrastructure, and trade with others comes after that'' said Canada's minister Gerry Ritz.

There was more consensus on the need to tackle the market speculators who inflame prices.

``There is total uncertainty today,'' on the available volumes of foodstuffs, Le Maire complained.

``It's not normal that their is so little information,'' he added, calling for more transparency to stabilise the market.

bangkokpost.com

-

23-01-2011, 10:54 AM #57Member

- Join Date

- Jun 2009

- Last Online

- 12-02-2011 @ 03:52 PM

- Posts

- 139

Will certainly mess this country up, people are quite fond of their food.

-

23-01-2011, 11:03 AM #58

-

23-01-2011, 11:15 AM #59Thailand Expat

- Join Date

- Feb 2008

- Last Online

- 11-11-2018 @ 05:44 PM

- Location

- Klong Samwa

- Posts

- 15,308

If the money gets to the farmer

good news

-

23-01-2011, 11:22 AM #60

Supply and demand. If Africa and South Asia stopped reproducing willy nilly there wouldn't be so many scrounging mouths to feed.

-

23-01-2011, 01:33 PM #61

-

24-01-2011, 03:26 AM #62Banned

- Join Date

- Jun 2010

- Last Online

- 16-09-2024 @ 09:46 AM

- Location

- Canada

- Posts

- 10,512

It is all inflation from flawed keynesian monetary expansion in the US. Since the US dollar is the worlds reserve currency(for the time being), countries with soft or hard dollar pegs feel the inflation first.

These coutries need to revalue their currencies higher and export that inflation back to the US where it came from. Eventually they will do this and the inflation will show up in the US.

Stimulus money printing does not work, never has, never will.

-

24-01-2011, 03:34 AM #63Banned

- Join Date

- Jun 2010

- Last Online

- 16-09-2024 @ 09:46 AM

- Location

- Canada

- Posts

- 10,512

It is mainly a monetary issue, nothing else.

Central banks around the world are printing money to bail out insolvent banks. The problem is that a central bank has nothing. A central bank can only spend purchasing power that already exists by printing money or conjuring money digitally.

They are diluting the money supply which devalues currencies which shows up as higher prices for commodities.

-

24-01-2011, 03:41 AM #64Banned

- Join Date

- Jun 2010

- Last Online

- 16-09-2024 @ 09:46 AM

- Location

- Canada

- Posts

- 10,512

Not sure where you live but you will be in for a wakeup call when some of these creditor countries like China, Thailand, Korea, brazil, Hong kong and the oil states loosen their currency pegs against the US dollar. The inflation will be headed to the western world where it came from.

-

24-01-2011, 03:54 AM #65Banned

- Join Date

- Jun 2010

- Last Online

- 16-09-2024 @ 09:46 AM

- Location

- Canada

- Posts

- 10,512

Everyone here is missdiagnosing the problem.

Do people eat gold ? No, so why is gold at all time highs ?

It is all monetary inflation, better discribed as currecny devaluation. This is what happens when you implement reckless monetary policy to bailout the banking system when we would have all been further ahead by now, if we let the system collapse and rebuild like Asia did in 1997.

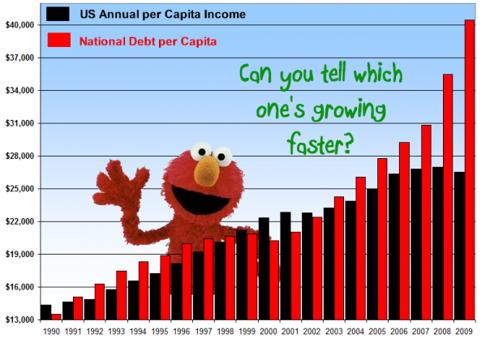

The problem is, its the world reserve currecny that is being printed and devalued. Maybe a picture would help people understand.

If you save your money in the only non paper currecy in the world, gold, then you will feel no inflation.

If you save your money in the only non paper currecy in the world, gold, then you will feel no inflation.

-

24-01-2011, 04:01 AM #66Banned

- Join Date

- Jun 2010

- Last Online

- 16-09-2024 @ 09:46 AM

- Location

- Canada

- Posts

- 10,512

It does not work that way. The savers of the world are having their saving diluted by the central bank printing money.

Savers that are trying to avoid a loss that is being pushed on them by a central bank are not "worthless speculators"

If I have $100,000 in my savings account that is being diluted by a central bank then I have every moral right to save my $100,000 in the form of oil, rice, wheat or whatever I want.

-

24-01-2011, 04:12 AM #67Thailand Expat

- Join Date

- Feb 2006

- Last Online

- @

- Posts

- 38,456

In terms of 'soft' or agricultural commodities, there are a few factors at play. Certainly a weaker USD, and expectations of inflation, provides a filip to USD trading prices. But there is also the supply and demand picture.

There have been several supply shocks because of volatile weather patterns. Stockpiles are low too.

In certain soft commodities- sugar and wheat for example- there is also an explosion in demand. Emerging nations in particular are not just eating more- they are increasingly favoring food products made with sugar and wheat, and several other commonly traded agricultural commodities. It seems the world has an addiction to carbs.

In common with commodity markets in general, the 'bull market' that has emerged in the last few years followed an extended bear market. Returns on investment were paltry, and thus investment in new production was starved, Hopefully that is being addressed as we speak.

Emerging demand, supply shocks, low stockpiles, USD weakness and inflationary concerns- it's all there. I don't think we're near the end of this bull market yet.

Fact is, the world needs more investment in efficient food production to feed itself. Rising commodity prices will at least help to ensure that.Last edited by sabang; 24-01-2011 at 05:22 AM.

-

24-01-2011, 04:57 AM #68Banned

- Join Date

- Jun 2010

- Last Online

- 16-09-2024 @ 09:46 AM

- Location

- Canada

- Posts

- 10,512

Watch the price of cocoa tomorrow.

"Bond Recoveries Or Chocolate": Ivory Coast Issues Ultimatum With Cocoa Export Ban, As Chocolate Prices Set To Surge Monday | zero hedge

-

24-01-2011, 06:11 AM #69I am in Jail

- Join Date

- Sep 2007

- Last Online

- 28-03-2013 @ 09:01 AM

- Posts

- 1,410

-

24-01-2011, 06:37 AM #70Thailand Expat

- Join Date

- Feb 2006

- Last Online

- @

- Posts

- 38,456

No need to panic-

This is more the problem-

The 'correct price' for any commodity is hard to figure given the complexities that factor into it, and the cyclical nature of markets. But food prices were certainly too low for too long- it's not all bad that we're seeing a rebound now. There are a lot of hungry mouths to feed. The real long term solution might be to offer free contraceptives.

The End of America? Not Quite - Seeking Alpha

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Reply With Quote

Reply With Quote