Already the "strong" currencies are only available at negative rates. The US$ and the £ look to be going that way.

Easily sold physical assets, with a proven global market, seem to be the way to retain any value. Arable land is only good if you can protect your crops from the impending hungry masses and you have the equipment/fuel/fertilizer/seed to work it. Real estate if the cities remain policeable.

View Poll Results: Is another market crash on the way or is all okay?

- Voters

- 36. You may not vote on this poll

-

Things should improve, invest in the markets.

4 11.11% -

The future doesn't look good. Stay out of the markets.

17 47.22% -

Things should remain flat. DOn't expect big losses or gains.

4 11.11% -

I really don't know.

11 30.56%

Results 51 to 75 of 157

-

14-08-2012, 05:44 AM #51Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Today @ 12:32 PM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,292

A tray full of GOLD is not worth a moment in time.

-

05-11-2012, 09:39 AM #52

Does anyone think we are set for another drop in markets this week? Asian markets are already dropping. There doesn't appear to be much positive news. Plus people might want to cash out prior to the US election just to be safe. I say today is going to be interesting especially in the US.

-

08-11-2012, 02:47 AM #53Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Today @ 12:32 PM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,292

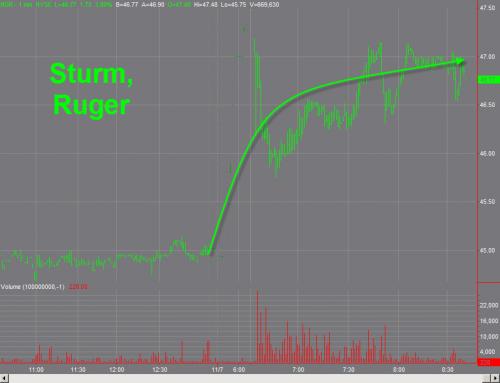

The "markets" have given you answers.

On a day of supposed celebrations, the financial markets cratering there are a couple of companies still growing.

-

21-12-2012, 10:36 AM #54

US Overnight Futures Are Fading As Boehner's 'Plan B' Vote Is Up In The Air - Business Insider

UPDATE (8:52PM ET):

Futures are off of there lows. But they're still low.

Dow futures are down 182 points, and S&P futures are down 19 points.

Premarket Stock Trading - CNNMoney

-

21-12-2012, 11:24 AM #55Tonguin for a beer

- Join Date

- Jun 2006

- Last Online

- 25-09-2016 @ 09:58 PM

- Location

- Wat Bung

- Posts

- 3,845

Question. I have a sizable amount of USD paid to me in a compensation claim and for the past few months I have been trying to think what to do with it. It is just sitting in the bank at the moment.

I'm very wary of investing in stocks because I have no idea about it.

I have been looking at buying a rental property in Perth or Broome in Western Australia as that is where I am from originally and the market seems to be picking up. I am hoping the rent will pretty much cover my cost of living here. I see I can get around 5% in Perth or 6% in Broome return. (I am interested in Broome as there is a huge gas field project there awaiting federal approval, I think it will happen)

Would I be better off in shares?

To me it seems getting monthly rental payments and the prospect of capital gains is the better option.

I have never traded in shares in my life.

Any thoughts welcome. I am tired of thinking about what to do.Fahn Cahn's

-

21-12-2012, 11:42 AM #56so don't do it, 99% of individual investors will lose money in the Stock market as they lack the tools, data and the discipline to follow smart trading strategies

Originally Posted by Bung

Originally Posted by Bung

buy a cheap property if you can find one,

or do like everyone else with no clue, buy Gold

-

21-12-2012, 12:22 PM #57Tonguin for a beer

- Join Date

- Jun 2006

- Last Online

- 25-09-2016 @ 09:58 PM

- Location

- Wat Bung

- Posts

- 3,845

Thanks for your frank answer. I feel that not having any experience in the stock market would exclude me somewhat from trading unless I start learning it first. Or pay someone to do it for me which seems foolish also.

So I am left with real estate? Another aspect I am interested in is the fact it gives me and escape route plan B if I need it.

Am I missing something?

Sorry, I am probably hijacking the thread....

Just curious about what an experienced investor would do in my case.

-

21-12-2012, 05:52 PM #58

As an average Joe, looking at it. I would think Australia will always feel pressure on the land as it is an attractive country for immigration. Right now though isn't the mining industry in a slump? Anyways, as they say 'Land, they aren't making anymore of that.'

Not sure about stocks or gold these days. Some positivity and some negativity. I know little about Australia's situation.

Jeff Gundlach's Bloomberg Interview - Business Insider

-

21-12-2012, 05:54 PM #59

Still looks like shares in the US might get hit today. Are markets open Monday?

-

21-12-2012, 06:42 PM #60Thailand Expat

- Join Date

- Feb 2009

- Last Online

- 04-11-2019 @ 05:15 AM

- Posts

- 3,857

I spent many years playing the market. Reasonably successfully.

I stopped a long time ago. Currently I'm broke, but that is as a result of my personality and has nothing to do with my trading.

I would again caution about the markets. Short term it'll go up and down. Call it at your own peril.

2008 was a game changer. Much has been done to bring things back onto the old rails, but it's not working. The EU is buying it's own debt, the Americans are desperately doing the only thing they seem to know in trying to solve their ridiculous debt problem, shop. China is teetering on the edge.

Iv'e always said that in 2008 we fell off a cliff, only to land on a ledge and that we are going to roll off that ledge.

I'm convinced we are heading for phase 2, much bigger than phase 1.

Which is why I've spent every bit of time and energy I had over the past 3 years working on something to ensure my wife and daughters future.

I've never been a 'the end is nigh' kinda guy. But look at the whole picture and ask yourself how the fuck is anybody gonna put Humpty together again.

-

21-12-2012, 06:46 PM #61

You depress me but deep inside I feel the same about things. It's hard to believe in anything good happening these days. Crash or not though people still need food, shelter and clothing.

-

21-12-2012, 06:50 PM #62Thailand Expat

- Join Date

- Feb 2009

- Last Online

- 04-11-2019 @ 05:15 AM

- Posts

- 3,857

^They do. But for that they need money and for that they need jobs. If they ain't got those jobs they can't buy Apple's shit, and the spiral accelerates. It's the madness of the super-consumer economy. It's a bubble that had to burst.

-

21-12-2012, 07:00 PM #63

I'm not arguing with that. I'm just saying in the end some things will survive. I expect the whole IT thing to crash anyways. I don't expect to see myself screwing around online as much as I do now. A lot of people are experiencing burnout from using computers, the internet and all the communications crap. It's addictive and many people want to escape from sitting in front of electronic screens. Addiction isn't always easy to break free from but with electronics if you can get rid of the electronics you can get free. Nature is the future.

-

21-12-2012, 07:01 PM #64

-

21-12-2012, 07:20 PM #65Thailand Expat

- Join Date

- Feb 2009

- Last Online

- 04-11-2019 @ 05:15 AM

- Posts

- 3,857

We have become so wound up that we can't spend any amount of time without our toys, which aren't toys anymore but 'necessities'. In doing so we simply do not have the time to assimilate the bigger picture and wtf we are doing in this mess we call the modern world.

When the power went out here a while ago I went fukkin nuts.

That said I'm not a survivalist. Love nature, being from Africa I miss space and quiet. But I also like communicating, exchanging ideas and lots of females.

Thing about the world economy that gets me is that everybody bought into what is essentially a giant ponzi scheme, and now it's collapsing. I've never been a consumer, have little need to own stuff and have no respect for money, when I had it and when not.

It pisses me off that nobody seems to be able to see anything of note anymore, just the immediate crap they've been indoctrinated to salivate over. Can't remember it being like this when I was young. These days everybody seems to have chosen to be a moron.

I suppose I gotta say: Rant over.

-

24-12-2012, 10:29 PM #66

-

25-12-2012, 02:23 PM #67

Some Teakdoor members seem to like this man, others don't but thought this was a worthwhile contribution to the discussion.

GLOBAL ECONOMIC COLLAPSE: Marc Faber - "Prepare For A Massive Market Meltdown"?!

-

25-12-2012, 04:12 PM #68Thailand Expat

- Join Date

- Jun 2005

- Last Online

- 08-09-2014 @ 10:43 AM

- Location

- Simian Islands

- Posts

- 34,827

Many people are predicting that Aus is teetering on the edge of a property crash. I'd wait and buy after the crash. I'm sure having the money sitting in the bank for a year or two to see what happens is probably the safest option and therefore what will give you the biggest return in the long term.

Or you can be an idiot and buy gold like I did today.

-

25-12-2012, 04:50 PM #69

I used to like this guy more. I'm not sure if I believe him as much. He never gives clear answer. How long as he been saying the world is collapsing? I don't doubt there are serious issues out there but I just am starting to think this guy is just another guy out there without any breakthrough information.

-

04-01-2013, 10:28 AM #70I think he is mad, he is basically a journalist selling stories

Originally Posted by Imminent

Originally Posted by Imminent

-

04-01-2013, 07:22 PM #71Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Today @ 12:32 PM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,292

It's getting pretty bad now, but hold your nerve Utopia, for some, is coming. Hallelujah! Originally Posted by Marmite the Dog

Originally Posted by Marmite the Dog

-

04-01-2013, 07:25 PM #72Member

- Join Date

- Dec 2012

- Last Online

- 07-02-2015 @ 10:54 AM

- Posts

- 83

Been reading up on this and if the US and abama had not come up with that plan no matter what it is were were all fooked .

-

04-01-2013, 07:54 PM #73

Property prices in Perth have slowed down some what and many people are getting back in the market before they go again.

Because of the resources boom many people making big money have forced house prices up quickly.

Rents have sky rocketed in the last 12 months and many people are doing it hard.

A two bedroom unit in a reasonable area brings $400 plus K easy and one must go live in a shit area to get anything cheaply.

Rents on a 400k 2 bedroom unit bring 400 bucks minimum a week and there is a large shortage of rentals.

Sling it to an agent and they charge 10% to manage it. Tax deduction there.

Can do a lot worse than safely investing your money in Perth real estate especially if its a compo wind fall. Don't want to risk that do you.

A well placed unit will hold its value even when real estate prices slump as they did in the last few years.

My unit has gone from 180 K 8 years ago to 420 K to day.

I'll be renting out when I retire.

-

05-01-2013, 12:27 AM #74

That's a mug's game Terry. The ROI (return on investment) needs to be 7-8% to make it worth an investment in anything - including property. A 400K condo renting out at 1,600 per month doesn't cut it, especially if you are into the bank for part of that. Same-Same in Melbourne and Vancouver, Canada where the prices got stupid in recent years. It's now cheaper to rent in those places than buy. The British bank calculation method of "affordability" is pretty much omni present around the western world. While calculated in different ways, it still comes out to three times your annual gross income as a max value a bank will lend. Aus and Canada are prime examples of how fcuked up things got - and are now starting to correct.

Here's how it works:

Australia and Canada - both countries have annual average lower-middle class salaries of around 50k (some in Aus could only wish, I know). Anyway, that means $ 150,000 maximum lending from the bank. But that would still be around $1,200 a month repayment to the bank plus the condo fee of likely 350/month.

No gain. - No reason to invest unless you are really certain in a long term price rise. Any takers on further long term price rises in property in these places?My mind is not for rent to any God or Government, There's no hope for your discontent - the changes are permanent!

-

10-02-2013, 05:50 PM #75Member

- Join Date

- Sep 2012

- Last Online

- 13-08-2013 @ 04:46 AM

- Posts

- 70

I recently took some big stock profits and went largely to cash. Too old to experience a deep drop in value.

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Reply With Quote

Reply With Quote