Any concerns?

Results 101 to 125 of 203

-

04-09-2021, 05:47 PM #101Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Today @ 08:19 AM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,240

-

04-09-2021, 05:56 PM #102

-

26-10-2021, 12:01 PM #103Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Today @ 08:19 AM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,240

Liz Ann Sonders

@LizAnnSonders

Chief Investment Strategist, Charles Schwab & Co., Inc.

"Netting out the inventories component from GDP.

Real final sales (using @AtlantaFed estimate).

Are expected to contract at a -1.6% annualized rate in 3Q21.

Historically that decline was just prior to or in beginning of recessions"

https://twitter.com/LizAnnSonders/status/1452687379924463623

Will Q4 haul it into positive territory?A tray full of GOLD is not worth a moment in time.

-

29-10-2021, 06:25 AM #104

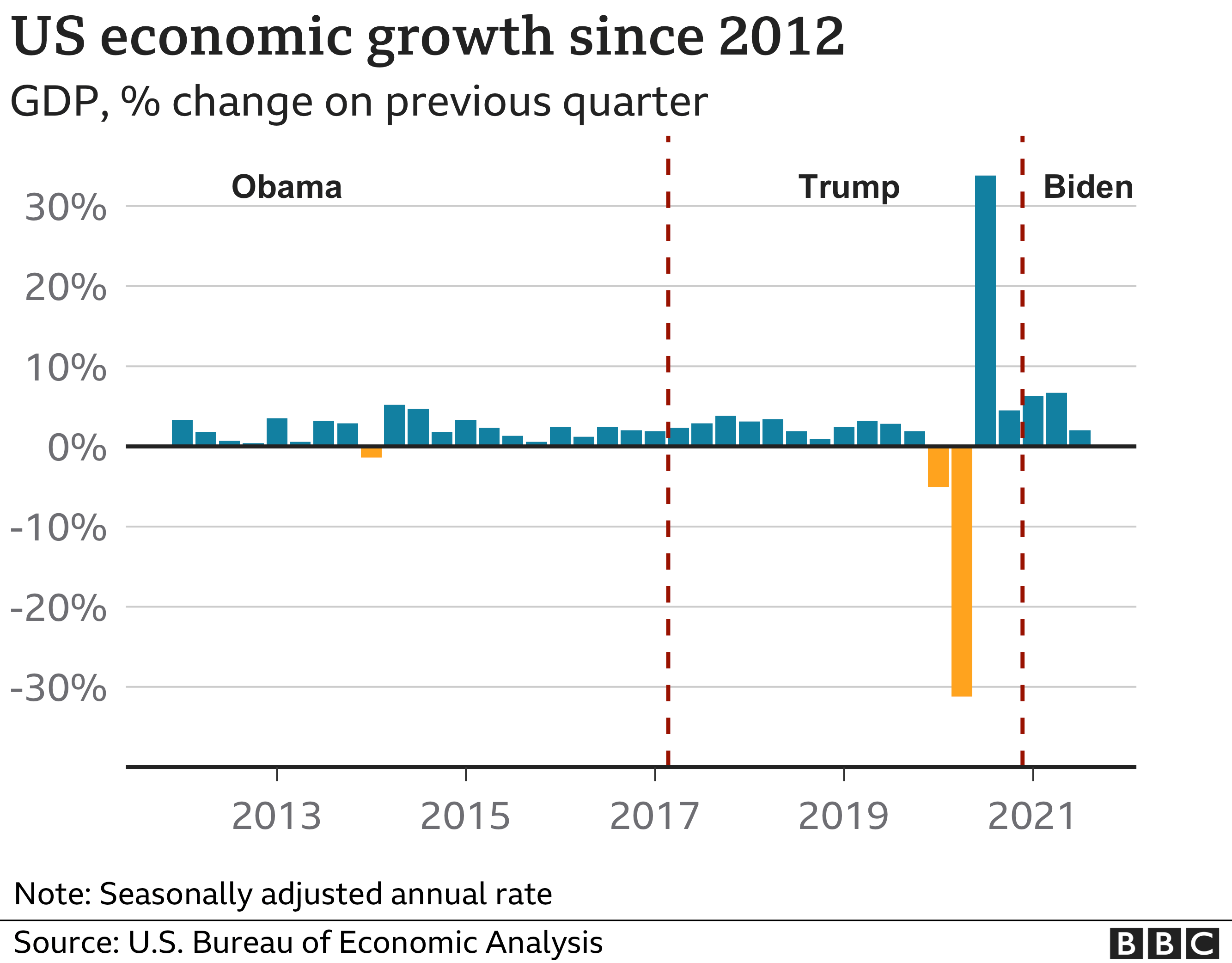

- Similar to other large economies/wealthy nations, recovery from Covid is slowing growth.

Economic growth rate slows to 2 percent as delta derails recovery

Economic growth slowed sharply between July and September as the emergence of the COVID-19 delta variant derailed the recovery from the coronavirus recession, according to data released Thursday by the Commerce Department.

U.S. gross domestic product (GDP) grew at an annualized rate of 2 percent in the third quarter, according to the Census Bureau’s first estimate. The economy grew at a 6.7 percent yearly pace in the second quarter of 2021, marking a sharp slowdown as the delta surge began.

“The increase in third quarter GDP reflected the continued economic impact of the COVID-19 pandemic. A resurgence of COVID-19 cases resulted in new restrictions and delays in the reopening of establishments in some parts of the country,” the Census Bureau explained.

- When comparing the GDP with the last president, it’s not bad.

- Job growth

- Just for fun. The Dow

Keep your friends close and your enemies closer.

Keep your friends close and your enemies closer.

-

02-11-2021, 05:51 AM #105

Slowly getting back to some type of normal……..

70% of US adults are fully vaccinated, 80% partially: White House

Stocks rose slightly to new records on Monday — the first trading day of November — after markets emerged from a historically tough seasonal period successfully.

The Dow Jones Industrial Average rose 94.28 points to 35,913.84, helped by gains in Boeing and Dow Inc., closing at a fresh record. The S&P 500 rose nearly 0.2% to 4,613.67, closing at an all-time high. The tech-focused Nasdaq Composite added 0.6% to 15,595.92 and also hit a closing record.

The small-cap benchmark Russell 2000 rallied 2.6% for its best day since Aug. 27.

The other big event for the week will be October’s employment report Friday, which could show some improvement in hiring, as new cases of Covid-19 continued to decline.

-

03-11-2021, 05:54 AM #106

Dow closes above 36,000 for the first time

Dow Jones, Nasdaq Hit Record Highs; Apple, Microsoft Advance; Goldman Sachs Scores Breakout

The Dow reached another record high on Tuesday. Meanwhile, the S&P 500 and Nasdaq also set new records, continuing this week's strength.

-

04-11-2021, 06:57 AM #107

Stocks climbed to more record highs Wednesday after the Federal Reserve said it will begin dialing back the extraordinary aid for the economy it has been providing since the early days of the pandemic.

The Fed said it will begin reducing its $120 billion in monthly bond purchases in the coming weeks by $15 billion a month. The central bank’s announcement was in line with what markets expected.

On Wednesday:

The S&P 500 rose 29.92 points, or 0.6%, to 4,660.57.

The Dow Jones Industrial Average rose 104.95 points, or 0.3%, to 36,157.58.

The Nasdaq rose 161.98 points, 1%, to 15,811.58.

The Russell 2000 index of smaller companies rose 42.42 points, or 1.8%, to 2,404.28.

-

05-11-2021, 10:13 AM #108

U.S. weekly jobless claims better than expected in another sign of healing for employment

The U.S. unemployment picture improved again last week, with initial filings for unemployment insurance falling to another pandemic-era low.

First-time claims dropped to 269,000 for the week ended Oct. 30, down 14,000 from the previous period and better than the Dow Jones estimate for 275,000, the Labor Department reported Thursday.

In other news……..

Nasdaq set a fresh record. The S&P 500 also eked out a new high.

Just for fun……….

Business activity surged in October

The Delta variant’s impact on the economy is receding into the past — business activity surged in October, per a closely watched index.

Driving the news: The ISM Services PMI, an index that measures all nonmanufacturing activity, jumped by a record 4.8 points to a reading of 66.7 (also an all-time record high).

The big picture: “The surge in the index sends a positive signal about the post-Delta economy, with the business activity and new orders components soaring,” Ian Shepherdson, chief economist at Pantheon Macroeconomics, wrote in a research note.

- Yes, but: Supplier delivery times were slower, prices paid were higher, and the order backlog was larger — all indicating the persistence of supply chain problems, he added.

-

05-11-2021, 09:22 PM #109

Job creation roars back in October as payrolls rise by 531,000

The U.S. job market snapped back in October, with nonfarm payrolls rising more than expected while the unemployment rate fell to 4.6%, the Labor Department reported Friday.

Nonfarm payrolls increased by 531,000 for the month, compared with the Dow Jones estimate of 450,000. The jobless rate had been expected to edge down to 4.7%.

Private payrolls were even stronger, rising 604,000 as a loss of 73,000 government jobs pulled down the headline number. October’s gains represented a sharp pickup from September, which gained 312,000 jobs after the initial Bureau of Labor Statistics estimate of 194,000 saw a substantial upward revision in Friday’s report.

Biden Delivers Remarks on October Jobs Report

Wall Street sets new records after strong Oct jobs report

The S&P 500 rose about 2% for the week to mark a fifth consecutive weekly gain — its longest winning streak since August 2020. The Nasdaq also jumped to a record the broad move higher in tech shares, and the Dow reached a record close as well.

Last edited by S Landreth; 06-11-2021 at 04:16 AM.

-

09-11-2021, 07:17 AM #110

-

17-11-2021, 09:37 AM #111

Retail sales jumped 1.7 percent in October, according to data released Tuesday by the Census Bureau, beating expectations and rising for the third straight month.

U.S. retailers, restaurants and bars made $638.2 billion in sales last month without adjusting for inflation, up from $627.5 billion in September. Analysts expected a 1.4 percent increase from September, which saw sales grow 0.8 percent from August, according to revised figures released Tuesday.

The surprisingly strong month of retail sales is a promising sign for the U.S. economy amid high inflation and plummeting consumer confidence.

- The government dramatically underestimated job growth this summer

The government sharply underestimated job gains for most of 2021, including four months this summer in which it missed more job growth than at any other time on record.

In the most recent four months with revisions, June through September, the Bureau of Labor Statistics (BLS) reported it underestimated job growth by a cumulative 626,000 jobs — that’s the largest underestimate of any other comparable period, going back to 1979. If those revisions were themselves a jobs report, they’d be an absolute blockbuster.

In an average month before the pandemic, estimates would be revised by a little over 30,000 jobs, or just 0.02 percent of all the jobs in the United States. The recent revisions to the jobs reports have been much larger.

The missing jobs surfaced through revisions to the widely watched non-farm payrolls number that BLS releases each month. The data is considered preliminary until it has been revised twice. The fixes are typically minor, but recent revisions have been big enough to turn a substantial slump into a surprising surge.

These waves of revisions in the same direction tend to happen at turning points in the labor market. BLS relies on highly technical models to adjust for seasonal patterns, business closures and other factors, to catch new trends in the labor market and make revisions quickly.

It’s happened before during this pandemic. Revisions in the already calamitous months of March and April 2020 found the economy had lost 922,000 more jobs than initially reported. Also, earlier in the pandemic, BLS drew criticism for a misclassification error in a different survey, which BLS economists said greatly understated the unemployment rate. Due to the way certain survey questions were interpreted, millions of workers who said they had a job but couldn’t work due to coronavirus shutdowns were marked as absent rather than as temporarily unemployed.

A ‘misclassification error’ made the May unemployment rate look better than it is. Here’s what happened.

This time, the payrolls data has been obfuscated as businesses have been slow to respond to government surveys amid the chaos of the pandemic — part of a larger pattern in which the deadly virus has wreaked havoc on federal statistics.

Angie Clinton, the BLS section chief who oversees the payroll number crunching, said there have been more large revisions since the start of the coronavirus pandemic, but that revisions are a sign of the system working as intended.

“We’re just improving the estimate using everything we know up through the month we’re releasing, really,” Clinton said. “I mean, it sounds counterintuitive to most people because revisions — they think, ‘Oh, they got it wrong the first time.’ But no, we got it right, based on what the sample told us. But going forward we receive more sample, some corrected records, and recalculate seasonal factors, which together may indicate a different story.”

The revisions have recast the narrative of a summer slowdown. In August, when economists expected a strong follow-up to the 943,000 jobs the economy added in July, the BLS announced the U.S. added only 235,000 jobs. Headlines dubbed it a “colossal miss” as job growth took a “giant step back.” Two months later, revisions based on additional data showed August jobs grew by 483,000, more than double the anemic original reading. It was the biggest positive revision in almost four decades.

When it was reported the economy added just 194,000 jobs in September, headlines called it “ugly,” “dismal” and “disappointing.” A month later, a revision showed the economy had actually added 312,000 jobs in September.

After the revisions, disappointing months like August looked a lot more like October, a month that was hailed as a labor market rebound. In hindsight, while a blockbuster June and July were even better than they looked, they didn’t lead to months of stagnation — they diminished somewhat, but still produced solid, steady growth that continued through October.

President Biden may have even paid a political price for the lackluster jobs numbers. From April to June, polls found that most Americans (51 percent) approved of Biden’s handling of the economy, according to an average of polls from Fox, NBC, Quinnipiac and The Post. But as bad economic numbers came out and the national political climate turned south, those numbers fell steadily — in October, just 39 percent approved of Biden’s handling of the economy, while 57 percent disapproved.

“Naysayers and detractors from Biden’s agenda are going to exploit any ‘bad’ economic indicator they can as evidence for why Biden has it wrong on the economy or why Biden’s Build Back Better proposal gets it wrong on the economy, and in that sense underestimates of the jobs numbers are not helpful,” said Lindsay Owens, executive director of the left-leaning Groundwork Collaborative.

However, Biden’s falling economic-approval numbers during that period could also be attributed to other issues, such as rising inflation and the controversial and abrupt Afghanistan withdrawal, which have dragged Biden’s approval down across the board, Owens said. In that environment, a few slow jobs reports may not been the primary driver of public opinion, Owens said.

Each month’s revisions simply reflect economists’ new best estimate, based on additional data. For example, when businesses report a surprisingly good month, such as this October, the seasonal adjustment algorithms look back on previous months with the benefit of hindsight. A good October likely didn’t come out of nowhere: the August and September estimates probably missed some growth. So, some of the jump in October is assumed to have occurred earlier, and a portion of the October gains are reallocated back to previous months.

These best-guess first estimates are often refined as responses straggle in from more of the 697,000 establishments surveyed each month, including major employers, government agencies and a rotating cast of small businesses. The businesses are asked how many people they employ, how much those people are paid excluding bonuses, and how many hours those are paid for.

In a typical recent month, about a quarter of the responses have come in late. When businesses don’t respond, economists and their models must account for all the reasons a business might not return a survey, including the possibility that it may have suddenly closed up shop. They must also account for newly formed businesses that won’t be on their survey rolls quite yet.

Jane Oates, the president of the employment-focused nonprofit WorkingNation and a Labor Department official in the aftermath of the Great Recession, said the coronavirus crisis and subsequent worker shortage put many employers under amazing stress. One plausible explanation for the Labor Department’s chronic underestimates is that the employers who were hiring the most were too busy to respond to the survey, so initial responses missed the fastest-hiring firms.

“Back in the Great Recession, there were many employers who were impacted but now every employer is impacted. Everybody is scrambling for talent. And I bet there’s just a higher percentage of them missing the deadline,” Oates said.

Before the pandemic, about 60 percent of contacted businesses responded to the survey, BLS data show. By May 2021, the most recent month for which data is available, that had declined to 49 percent. Those low response rates may have played a role in the unusually high revisions seen during the past two years.

Rather than showing that BLS has failed, the revisions are a tribute to the agency’s commitment to getting the numbers right, said Cornell University economist Erica Groshen, who served as BLS commissioner from 2013 to 2017.

“They take their responsibilities very seriously,” Groshen said. “They’re very transparent about their methodology and they’re always trying to improve that.”

BLS is a professional civil-service agency. The only political appointee, the commissioner, has no access to numbers before they are finalized. The economists and statisticians entrusted with the jobs numbers work with almost fanatic secrecy, Groshen said.

When staffers worked in the offices, before the pandemic, security was so tight that, if window washers appeared outside their windows, staff would get up and close the blinds. Staff had to empty their own trash from their locked-down offices — outside workers, even cleaners, aren’t allowed to enter the inner sanctum of statistics. https://www.washingtonpost.com/busin...ed-job-growth/

-

20-11-2021, 04:24 AM #112

-

20-11-2021, 03:57 PM #113Thailand Expat

- Join Date

- Aug 2017

- Last Online

- Today @ 09:38 AM

- Location

- Sanur

- Posts

- 8,084

Is this more than just a post Trump ‘dead cat bounce’?

-

20-11-2021, 04:00 PM #114

there was also a little thing called COVID - the stimulus package is yet to work its magic so its still got more upside to come

-

20-11-2021, 05:17 PM #115

Just a continued long-term increase over the years. However, recently there is a noticeable steeper incline in the graph.

Really, just poking fun at the posters here who pulled their money out of the market/s because a new administration was coming into office. Uncertainty will cause some to panic.

-

25-11-2021, 02:07 AM #116

Weekly jobless claims post stunning decline to 199,000, lowest level since 1969

The ranks of those submitting jobless claims tumbled to their lowest level in more than 52 years last week, the Labor Department reported Wednesday.

New filings totaled 199,000, a number not seen since Nov. 15, 1969, when claims totaled 197,000. The report easily beat Dow Jones estimates of 260,000 and was well below the previous week’s 270,000.

-

25-11-2021, 10:22 PM #117I'm in Jail

- Join Date

- Oct 2016

- Last Online

- 08-02-2023 @ 01:23 PM

- Location

- I'm Dead

- Posts

- 7,133

Reality check about the supposed boom

Biden: Fact-checking claims about US economic progress

By Reality Check team

BBC News

Published

20 hours ago

Share

Related Topics

IMAGE SOURCE,AFP

IMAGE SOURCE,AFP

Image caption,President Biden says there's been major progress on the economy

President Joe Biden says the US has made "historic progress" on the economy in the last 10 months.

In a speech before Thursday's Thanksgiving holiday in the US, he also talked about price rises and supply chain problems.

We have been looking into some of Mr Biden's claims.

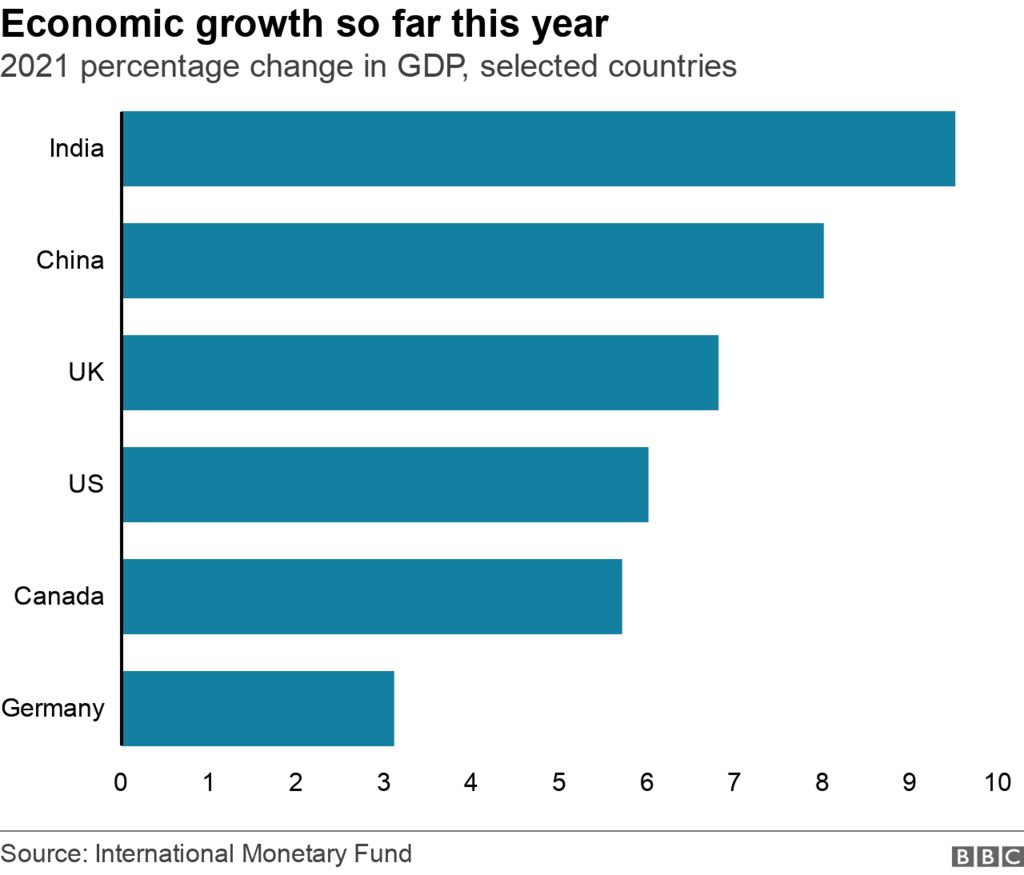

'We're experiencing the strongest economic recovery in the world'

Since shrinking by more than 30% in the first six months of 2020, the US economy has recorded a strong bounceback and returned to above pre-pandemic levels

China has also posted strong economic growth, but overall its economy didn't contract last year - meaning it had less damage to recover compared with the US.

Under Mr Biden, the US economy has continued to grow this year, but a large part of the recovery happened under former president Donald Trump.

Since President Biden came into office, the US GDP has grown by 6% in 2021.

This is less than several major economies - including the UK, China and India, according to data collected by the International Monetary Fund.

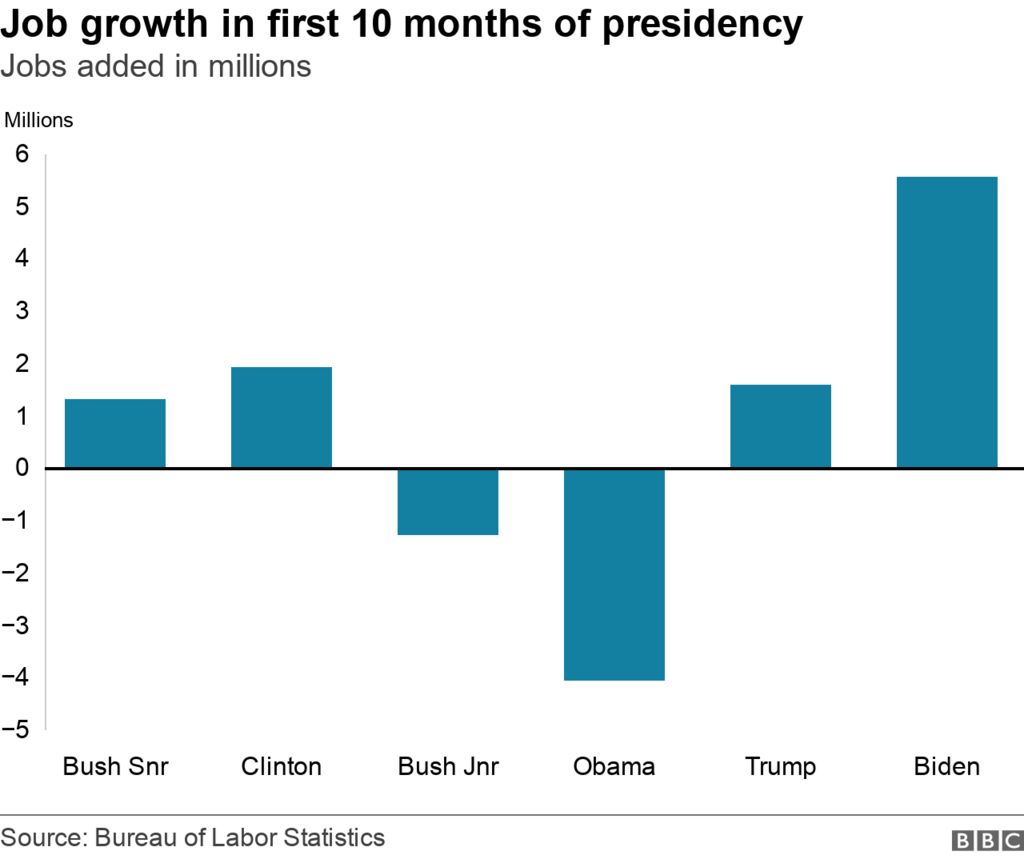

'Our economy has created a record 5.6 million jobs since I became president'

Mr Biden became president on 20 January this year.

From that month until October (the latest available data), the US economy added 5,583,000 jobs, according to the US Bureau of Labor Statistics.

This is the highest number of jobs created in the first 10 months of any presidency since records began in 1939.

But this job growth comes from a low base point, given that in April last year, unemployment hit its highest level since the Great Depression of the 1930s.

More than 22 million jobs were lost in the space of two months because of the impact of coronavirus.

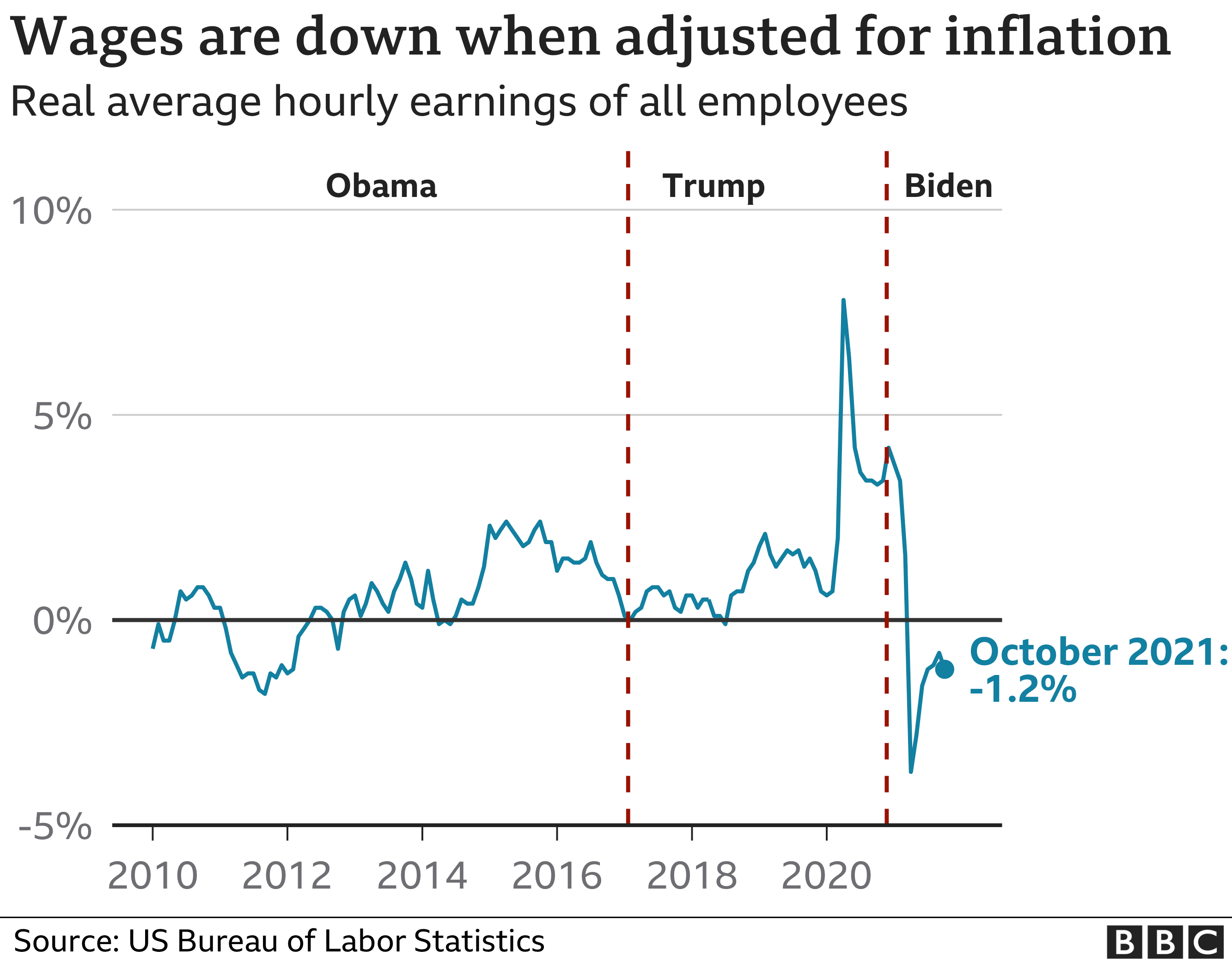

'Wages are rising'

Workers' wages in the US are up 4.9% this October compared with the same time last year.

But the cost of living is also going up, meaning more of the money people earn is spent on everyday goods, in particular food and fuel.

The cost of living for Americans has risen by 6.2% over the last year - the highest rise in three decades.

When inflation is taken into account, average hourly earnings decreased 1.2% from October 2020 to October 2021, according to the US Bureau of Labor Statistics.

'This is a problem not just here...but around the world. The price of gasoline has reached record levels recently in Europe and in Asia…'

"The price of gas in America, on average, is $3.40 (£2.55) a gallon," said Mr Biden, comparing it with France (about $7) and Japan (about $5.50) at the end of October.

These figures are broadly correct.

But there are countries where fuel prices are lower, such as Russia (about $2.5 a gallon) and some of the other major oil producers like Saudi Arabia, Nigeria, Iraq and the UAE.

And is a comparison between the US and France that relevant, given that in Europe there are significantly higher taxes on both petrol and diesel?

IMAGE SOURCE,REUTERS

IMAGE SOURCE,REUTERS

Image caption,Taxes on fuel in the US are lower than in European countries

According to the Washington-based Tax Foundation think tank, the average excise duty imposed on a gallon of petrol in the EU and UK was $2.40 in July this year.

That's just one tax - there are also other taxes in European countries.

The US federal tax on petrol was $0.18 per gallon and the average of all state taxes was $0.30, so much lower than in Europe.

'In the past three weeks, the number of containers sitting on docks, blocking movement, are down by 33%'

Mr Biden is talking about shipping containers coming into US ports and sitting on docksides because they are not being moved out fast enough.

This is because of shortages of truck drivers, and other supply chain issues which have created a backlog.

IMAGE SOURCE,GETTY IMAGES

IMAGE SOURCE,GETTY IMAGES

Image caption,Containers piled up at Los Angeles port in late October

On 22 November, the Port Authority of Los Angeles said there had been a 33% reduction in containers left on the docks after the authority warned it would start imposing fines on businesses who do not move containers out within a given time frame.

However, it is worth saying there were a record 84 ships waiting offshore in California on 6 November.

Gene Seroka, Los Angeles port executive director, was quoted as saying last week that there were also increasing numbers of empty containers left in the port, up by 18% in only a few weeks.

He said they were waiting for ships to come and take these empty boxes back to Asia to pick up manufactured goods.

-

26-11-2021, 03:05 AM #118

-

30-11-2021, 04:45 AM #119

Biden says 'consumer spending has recovered' to pre-pandemic levels

President Biden on Monday met with 10 CEOs from major retailers and grocers to discuss the holiday shopping season, touting the success of last week's Black Friday sales.

“Consumer spending has recovered to where it was headed before the pandemic. Early estimates are that Black Friday sales were up nearly a third since last year and in-store sales were up by even more than that,” Biden said.

United States Consumer Spending

Consumer Spending in the United States increased to 13723.73 USD Billion in the third quarter of 2021 from 13665.61 USD Billion in the second quarter of 2021. source: U.S. Bureau of Economic Analysis

-

30-11-2021, 07:59 AM #120Thailand Expat

- Join Date

- Aug 2017

- Last Online

- Today @ 09:38 AM

- Location

- Sanur

- Posts

- 8,084

No mention of the major indices being hit by reaction to Omicron virus?

Of course this has impacted exchanges world wide, but I recall such index performance previously being a favourite of yours?

-

30-11-2021, 08:31 AM #121

^big hit last Friday (for good reason) but rebounded a little today.

Last edited by S Landreth; 30-11-2021 at 08:46 AM.

-

04-12-2021, 08:33 AM #122

US jobless rate sinks to 4.2% as many more people find jobs

America’s unemployment rate tumbled last month to its lowest point since the pandemic struck, even as employers appeared to slow their hiring — a mixed picture that pointed to a resilient economy that’s putting more people to work.

The government reported Friday that businesses and other employers added just 210,000 jobs in November, the weakest monthly gain in nearly a year and less than half of October’s increase of 546,000.

But other data from the Labor Department’s report painted a brighter picture. The unemployment rate plummeted from 4.6% to 4.2% as a substantial 1.1 million Americans said they found jobs last month.

The U.S. economy still remains under threat from a spike in inflation, shortages of labor and supplies and the potential impact of the omicron variant of the coronavirus. But for now, Americans are spending freely, and the economy is forecast to expand at a 7% annual rate in the final three months of the year, a sharp rebound from the 2.1% pace in the previous quarter, when the delta variant hobbled growth.

-

10-12-2021, 04:00 AM #123

Weekly jobless claims fall to 184,000, the lowest level in more than 52 years

Weekly jobless claims tumbled last week, reaching a fresh 52-year low as the U.S. jobs market climbs out of its pandemic-era hole, the Labor Department reported Thursday.

Initial filings for unemployment insurance totaled 184,000 for the week ended Dec. 4, the lowest going back to Sept. 6, 1969, which saw 182,000.

- Statement from President Joe Biden on Unemployment Insurance Claims

Today, we received further evidence that our jobs recovery is one of the strongest ever. The number of Americans filing for unemployment last week was the smallest since 1969. The four-week average is now near the average for my predecessor even before the pandemic hit. This follows last week’s news that the unemployment rate has dropped to 4.2%, the fastest year-to-date decline in unemployment on record. We’ve added nearly six million jobs this year – the most of any first year President in history. And the number of people receiving unemployment benefits – which was over 18 million when I took office — is now at about 2 million. It is the fastest movement of people from relying on government support to earning a weekly paycheck in history. Thanks to the American Rescue Plan, and our successful vaccination program, Americans are back at work at a record-setting pace. And families have more money in their pockets: Americans on average have about $100 more in their pockets each month than they did last year, after accounting for inflation.

-

17-12-2021, 07:35 AM #124

U.S. jobless claims rise but still historically low at 206,000

The number of Americans applying for unemployment benefits rose last week despite signs that the U.S. labor market is rebounding from last year’s coronavirus recession.

Jobless claims rose by 18,000 to a 206,000, still low by historical standards. The four-week average, which smooths out week-to-week volatility, fell by 16,000 to less than 204,000, the lowest level since mid-November 1969 when the American job market was less than half the size it is now, according Department of Labor figures released Thursday.

Massive government aid and the rollout of vaccines helped revive the economy and the job market by giving Americans the confidence and savings to go on a shopping spree, often online, for goods such as lawn furniture and coffee makers. Since April last year, the United States has regained nearly 18.5 million jobs. But the economy is still 3.9 million jobs short of where it stood in February 2020, and COVID variants like omicron pose a risk to the recovery.

Employers added a disappointing 210,000 jobs last month. But the November jobs report also showed that the unemployment rate dropped to a pandemic low of 4.2 percent from 4.6 percent in October.

Businesses and other employers posted a near-record 11 million job openings in October. And 4.2 million people quit their jobs — just off the September record of 4.4 million — a sign that they are confident enough in their prospects to look for something better.

“Demand for labor is very strong and workers are in short supply, so layoffs are very low,” Gus Faucher, chief economist at PNC Financial Services Group, said in a research note. “Those workers who do find themselves unemployed can quickly find new jobs. The biggest problem for the labor market right now is too few workers.

-

23-12-2021, 05:13 AM #125

Getting back on track

U.S. stocks rose on Wednesday, rallying for a second day as the market continued to rebound from a three-day losing streak spurred by fears about the Covid omicron variant.

The Dow Jones Industrial Average gained 261.19 points, or 0.7%, to 35,753.89, bringing its two-day rally to more than 800 points. The S&P 500 climbed 1% to 4,696.56, on track for a winning week. The Nasdaq Composite climbed about 1.2% to 15,521.89. Trading stayed relatively thin ahead of the holidays.

The U.S. economy has improved more in President Joe Biden's first year in office than it has under any president in the last 50 years.

Bloomberg's Matthew A. Winkler made the observation in a column on Monday.

"U.S. financial markets are outperforming the world by the biggest margin in the 21st century, and with good reason: America’s economy improved more in Joe Biden's first 12 months than any president during the past 50 years notwithstanding the contrary media narrative contributing to dour public opinion," Winkler reported.

According to Winkler, Biden's economy ranked either first or second in 10 key measures when compared to the previous 10 presidents.

"[N]o one comes close to matching Biden's combination of No. 1 and No. 2 rankings for each of the measures," Winkler wrote.

"GDP growth in every incoming administration during the past four decades never exceeded 2.74% until 2021. Biden is now positioned to surpass Carter (5.01%) as the GDP champion of presidents since 1976," Winkler found. "Corporate America was never healthier than under Biden in 2021. Efforts to support consumers flowed through to America’s companies, which are enjoying profit margins of around 15%, the widest since 1950, according to the Bureau of Economic Analysis."

Winkler also suggested that inflation would not be as big of a problem for Biden as it was for President Jimmy Carter.

"Biden, unlike Carter, benefits from the $29 trillion U.S. debt market," he explained. "The clear message from the market that tells all other markets what to do is that the people with the most at stake are betting on the Biden economy."

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Reply With Quote

Reply With Quote