Results 26 to 50 of 203

-

24-04-2021, 12:42 AM #26

-

24-04-2021, 05:46 AM #27

-

24-04-2021, 06:32 AM #28

-

24-04-2021, 08:17 AM #29

-

24-04-2021, 10:03 AM #30

-

29-04-2021, 10:12 PM #31

U.S. economy accelerated at a robust 6.4 percent rate last quarter

Growth in the current April-June period is expected to be faster still, potentially reaching a 10 percent annual pace or more.

Economists say that widespread vaccinations, the reopening of more businesses, a huge infusion of federal spending and healthy job gains should help sustain steady growth. For 2021 as a whole, they expect the economy to expand close to 7 percent, which would mark the fastest calendar-year growth since 1984.Keep your friends close and your enemies closer.

-

30-04-2021, 09:17 PM #32

Q1 corporate earnings are roaring past expectations

In another sign of the coming economic boom, first-quarter corporate earnings are continuing to blast through expectations.

Why it matters: The rising fortunes of big companies are another element — along with trillions in government spending, vaccine-related reopenings and Fed policy — helping create what could be a record year of economic growth in the U.S.

-

30-04-2021, 09:20 PM #33

U.S. Household Income Surged by Record 21.1% in March

Higher income, spending and saving are expected to help power a fast economic recovery

Household income rose at a record pace of 21.1% in March as federal-stimulus checks helped fuel an economic revival that is poised to endure with an easing pandemic.

The surge in income last month was the largest monthly increase for government records tracing back to 1959, reflecting $1,400 stimulus checks and other government aid included in a $1.9 trillion fiscal relief package signed into law in March. Spending was also up sharply, increasing 4.2%, the Commerce Department said Friday. That was the steepest month-over-month increase since last summer.

Americans will have cash to spend as the economy reopens more in the coming months. The personal-saving rate rose to 27.6% in March from 13.9% a month earlier.

In March, consumers increased spending on goods by 8.1%, with a large chunk of that on big-ticket items. Spending on services advanced a more modest 2.2% last month following flat spending in February.

Widespread vaccinations and the broader reopening of the economy will help the recovery endure after the effects of fiscal stimulus fade, economists say.

MORE U.S. Household Income Surged by Record 21.1% in March - WSJ

-

30-04-2021, 10:18 PM #34

It's amazing isn't it. Just mail people money and "consumer" income goes up. Why didn't they think of this sooner.

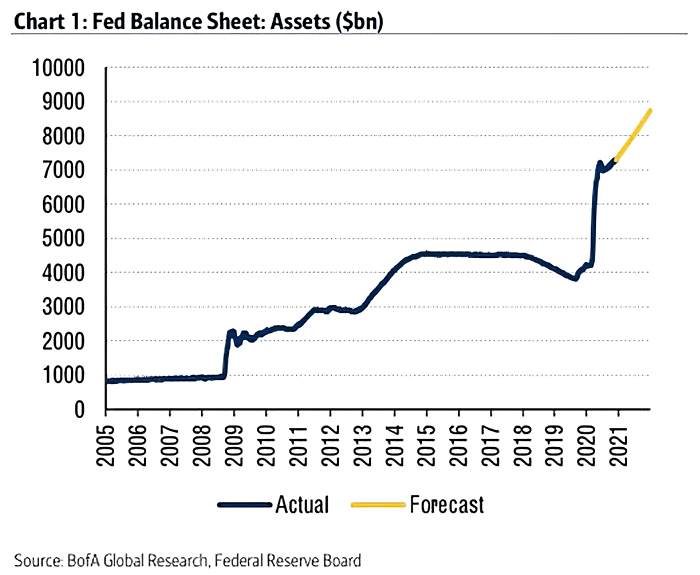

Where's the money coming from ? The federal reserve

-

30-04-2021, 11:27 PM #35Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Yesterday @ 08:20 PM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,239

God bless the FED and the taxpayers of ameristan.

Plus of course the foreign buyers of ameristani debt. The largest would be the two Asian countries, Japan and China.

"In January 2021, Japan owned $1.28 trillion in U.S. Treasuries, making it the largest foreign holder.

The second-largest holder is China, which owns $1.10 trillion of U.S. debt."

Who Owns the US National Debt? How Much Is Owed?

A tray full of GOLD is not worth a moment in time.

A tray full of GOLD is not worth a moment in time.

-

01-05-2021, 01:29 AM #36

-

01-05-2021, 04:47 AM #37

Stock market performance during Biden's first 100 days has officially bested everyone from Trump back through Truman

Certainly, presidents don't have much control over how the stock market performs. But if anything, LPL's chief market strategist Ryan Detrick argues "we think it means, whether you like Joe Biden's policies or not, the stock market is saying things are getting better," he tells Fortune.

-

21-06-2021, 11:27 AM #38Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Yesterday @ 08:20 PM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,239

Some quick perspectives on what's happening in markets: Potential major topping action and the possibility of a tradable low in June.

https://twitter.com/i/status/1405981344333709323

-

06-07-2021, 02:07 AM #39

Joe Biden's stock market is way ahead of Wall Street expectations

It's the half-way point of the year and President Joe Biden's stock market has quite the rally to show for itself: The S&P 500 (SPX) closed at a record high Wednesday and has already reached the target some analysts set for the entire year.

The index, the broadest measure of the US stock market, is up more than 14% in 2021, and just a couple of points below the 4,300 mark — a target Goldman Sachs (GS) had set for the end of the year.

The Nasdaq Composite (COMP) is also near record highs, albeit closing down 0.2% on Wednesday. For the year, the index has advanced nearly 13%.

That leaves the Dow (INDU) as the relative laggard of the three: it last hit a record high at the start of May. Nevertheless, the index is also up nearly 13% and continues to inch toward the 35,000 mark. The Dow closed 0.6%, or 210 points, higher on Wednesday.

-

06-07-2021, 02:32 AM #40

My house in Australia went up in value around 30-50000 this year since Biden got in.

-

10-07-2021, 04:11 AM #41

Major Indexes Close at Record Highs on President Joe Biden’s 170th day in office - WSJ

The S&P 500 staged a strong rebound Friday, finishing a topsy-turvy week at a fresh record.

The S&P 500 added 1.1% in 4 p.m. trading, following its worst one-day retreat since June 18. The Dow Jones Industrial Average added around 450 points, or 1.3%, and the Nasdaq Composite gained 1%, both closing at record highs.

Many investors rushed to buy the stock-market dip after Thursday’s declines, continuing a trend that has become a feature of the stock market’s rally over the past year. That desire, alongside easing concerns about the economic recovery, lifted stocks on Friday and overshadowed any worries about President Biden’s executive order to limit corporate dominance.

-

10-07-2021, 06:11 AM #42Thailand Expat

- Join Date

- Aug 2017

- Last Online

- Today @ 12:37 PM

- Location

- Sanur

- Posts

- 8,082

A very interesting thread, open to a wide interpretation of views.

As an outsider, the US stock market boom seems rather insular and parochial.

Good news if you are a democrat, but it’s probably worth considering the position is currently based on how well the US economy is doing under Biden. Is this upturn based on domestic, or global demand?

When the surge in growth for the Chinese economy stalled, they turned to the domestic sector, in order to boost earnings. Has the US money machine not done exactly the same?

Now, with the benefit of hindsight, the pessimistic views posted on here may yet gain some traction.

The worlds most successful economies were always based on continual growth, but that growth was also based on a global economy. Current growth will stall in the west, as foreign developing economies start to shrink. Africa and Asia are on the verge of a global Covid-19 shitstorm.

Japan has decided to go ahead with the Olympic Games, with no spectators. Their decision is based on media income from global brands.

Good luck with that. Unless something spectacular and unexpected arrives to stall Covid-19, there will be no global market for western economies to feed on. Domestic demand, propped up by free money stimulus, will only circulate for so long.

The biggest most dictatorial economy in the world depends largely on the efficacy of what seems to be the weakest COVID-19 vaccine programme. Chines generosity in distributing this vaccine to a third world, Ill equipped to deal with it, will only compound the failures seen in some western countries.

Covid 19 and the rise of mutating varieties, will stump even the best laid plans of the biggest and best western economies. Because at the time of writing, the western economies are currently looking inward, and patting themselves on the back, as they walk back from the Covid control mechanisms previously instituted by them.

This bubble is about to burst, and no one has a handle on it.

-

10-07-2021, 06:19 AM #43

The stock "markets" have been on the same trend line since 2009. All built on the same monetary policy wave that started then.

I really wanted the "markets" to implode under Trump. But it didn't happen. Covid was just a blip that was over in weeks.

If you brag about it , you own it. If I was Biden , I wouldn't brag too much about the stock "market".

-

10-07-2021, 06:47 AM #44Thailand Expat

- Join Date

- Aug 2017

- Last Online

- Today @ 12:37 PM

- Location

- Sanur

- Posts

- 8,082

-

10-07-2021, 07:19 AM #45

-

13-07-2021, 04:11 AM #46

Dow jumps 120 points to close just shy of 35,000 on earnings optimism on Joe Biden’s 174th day in office

The Dow Jones Industrial Average closed just shy of 35,000 as investors grew more optimistic ahead of second-quarter earnings reporting season set to kick off this week.

The Dow rose 126.02 points, or 0.4% to 34,996.18, a new record close. The S&P 500 added 0.4% to 4,384.63, also a record close. The Nasdaq Composite traded up 0.2% to a new closing high of 14,733.24. The S&P 500′s gain for the year so far now totals more than 16%.

-

24-07-2021, 04:08 AM #47

Dow Jones closes above 35,000 for first time on Joe Biden’s 185th day in office

S&P, Nasdaq also hit records

-

24-07-2021, 06:28 AM #48Thailand Expat

- Join Date

- Aug 2017

- Last Online

- Today @ 12:37 PM

- Location

- Sanur

- Posts

- 8,082

Sadly the stock market is an unreliable indicator of Covid-19 trends. The WHO charts show similar infection upticks for the USA, and the new epicenter of COVID-19 infections, Indonesia.

How to explain that the USA closed borders with Canada and Mexico on Monday, when both those countries have lower infection rates? Is it to stop Covid-19 from getting in - or getting out?

-

24-07-2021, 10:55 AM #49

-

25-07-2021, 11:01 AM #50Thailand Expat

- Join Date

- Aug 2017

- Last Online

- Today @ 12:37 PM

- Location

- Sanur

- Posts

- 8,082

Doomsday preppers are having a field day. Hiding in their bunkers, waiting for COVID-19 to die out.

I hope they don’t run out of baked beans.

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Reply With Quote

Reply With Quote