Results 151 to 175 of 218

-

23-10-2021, 06:12 AM #151

-

24-10-2021, 01:26 PM #152Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Today @ 08:19 AM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,240

Hopson Says Gross Contracted Sales For Eight Months Rose 37.2%

Oct 22 (Reuters) -

Hopson Development Holdings Ltd:

:GROSS CONTRACTED SALES FOR EIGHT MONTHS RMB30,200 MILLION.

GROSS CONTRACTED SALES FOR EIGHT MONTHS RMB30,200 MILLION, UP 37.2%.

PROPERTY CONTRACTED SALES FOR EIGHT MONTHS RMB28,616 MILLION.

0754.HK - Hopson Development Holdings Limited Key Developments | Reuters

BRIEF-China Evergrande Had Reason To Believe Purchaser Had Not Met Prerequisite To Make Offer For Shares In Unit

By Reuters Staff

Oct 20 (Reuters) - China Evergrande Group:

* ON 1 OCT GROUP ENTERED INTO AN AGREEMENT WITH HOOPLIFE TECHNOLOGY GROUP

* ASSET TO BE DISPOSED OF IS 5.42 BILLION SHARES IN EVERGRANDE PROPERTY SERVICES* CONSIDERATION WAS HK$20.04 BILLION

* AS OF 12 OCT, CO HAD REASON TO BELIEVE PURCHASER HAD NOT MET PREREQUISITE TO MAKE GENERAL OFFER FOR SHARES IN PROPERTY SERVICES UNIT

* EXERCISED ITS RIGHT OF RESCISSION/TERMINATION WITH RESPECT TO AGREEMENT ON 13 OCT

* REFERS TO DISPOSAL OF SHARES IN PROPERTY SERVICES UNIT, REPRESENTING 50.1% OF EXISTING ISSUED SHARE CAPITAL TO UNIT OF HOPSON

BRIEF-China Evergrande Had Reason To Believe Purchaser Had Not Met Prerequisite To Make Offer For Shares In Unit | Reuters

Not fixed yet.A tray full of GOLD is not worth a moment in time.

-

24-10-2021, 01:34 PM #153Thailand Expat

- Join Date

- Mar 2007

- Last Online

- 21-10-2023 @ 08:08 AM

- Location

- Way, Way South of the border now - thank God!

- Posts

- 32,680

Grim . . . well, it is China

-

24-10-2021, 02:10 PM #154Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Today @ 08:19 AM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,240

Here is a machine translated reply, to a question on the topic, to a government spokesperson:

"Q1 : With the ever-increasing events, do Chinese Bank of China and the Chinese government consider it necessary to take measures to avoid systemic risks?

Can private companies buy Evergrande bonds alone to do more for the people's central bank and the authorities?

A: The recent situation at Evergrande has attracted more attention. Evergrande is a real estate company, the main risk is that the debt due is not repaid, some sites shut down, pre-sold properties on time delivery uncertainty.

Overall, Evergrande risk is a case-by-case risk.

In terms of response measures, one of the things to avoid the spread of Evergrande's risk to other real estate companies.

The second is to avoid risk transmission to the financial sector.

Evergrande's liabilities are about $300 billion, of which a third are financial liabilities, decentralized creditors, and collateral, and the spillover of Evergrande's events is generally manageable for the financial sector.

We should deal with Evergrande on the principle that the legitimate rights and interests of creditors and property owners should be fully respected and protected in strict accordance with the order of compensation prescribed by law.

In this process, especially to protect the legitimate rights and interests of consumers who have bought a house.

We will adhere to the principle of rule of law and ensure that the legitimate and legitimate rights and interests of all creditors and stakeholders are treated fairly.

In general, I am confident that we can control the risk to a certain extent and avoid systemic risk."

Chinese language source:

http://www.pbc.gov.cn/goutongjiaoliu...458/index.html

-

24-10-2021, 02:17 PM #155

Warning: be cautious if you are a fragile pink

Yeah that's more chinky government propaganda innit. I reckong they've slipped them a few quid to stop them going bust.

-

25-10-2021, 09:06 PM #156Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Today @ 08:19 AM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,240

Evergrande resumes work for over 10 projects to address debt issues

By Global Times

Published: Oct 24, 2021 10:53 PM

"Indebted property developer Evergrande has resumed work and construction on more than 10 projects in Shenzhen and five other cities in South China's Guangdong Province to ensure the delivery of buildings, the company said on Sunday.

The announcement came after Evergrande Group Chairman Xu Jiayin said at a meeting on Friday that only through resumption of work and construction can the company ensure building deliveries and address its current debt problems.

According to a statement on the company's official account on WeChat on Sunday, some projects, including Shenzhen Evergrande City Light, have progressed to the stage of interior decoration, and they will be gradually delivered to buyers. Construction of other buildings like Shenzhen Evergrande City recently finished.

The company added that the all-out push to resume work and construction will shore up market confidence, as China's property market cooled in September due to concerns about the company's possible default.

The Global Times reported on October 10 that consumers from all over the country have set up dozens of online chat groups to urge the developer to resume work on half-finished buildings, after the company said earlier that some projects had been halted due to delayed payments to suppliers and contractors.

Aside from the all-out push to resume work and construction, Xu announced two other moves by the indebted developer to rescue itself on Friday, including the transition from property toward new-energy vehicles within 10 years, and plans to fully implement property sales, while substantially downsizing its real estate development and construction.

The company has readied funds for a last-minute US dollar bond interest payment, media reports said on Friday, fending off a default on its offshore bond.

Evergrande's debt crisis has attracted widespread attention from around the world, with some foreign media using the case to hyping up risks in the Chinese housing market and regulations to crack down on housing speculation.

Chinese officials have maintained that risks in China's housing market remain overall controllable despite individual problems that have arisen."

Evergrande resumes work for over 10 projects to address debt issues - Global Times

-

25-10-2021, 09:30 PM #157

Evergrande’s Proposed Shift From Real Estate To Electric Vehicles Fails To Convince

Hui Ka Yan has finally revealed his plan to save China Evergrande. He wants the embattled property developer to shift its focus from real estate to manufacturing electric vehicles, but skepticism abounds.

Despite having never sold a vehicle, Hui’s aim is to turn away from Evergrande’s main business and become an EV maker within the next decade, the state-run Securities Times reported late Friday evening, citing an internal meeting held on October 22.

The proposal sent shares of his Hong Kong-listed EV unit, China Evergrande New Energy Vehicle Group, soaring as much as 17% on Monday before closing the day with a gain of 11.4%. But the company still trades at just a fraction of its peak market value of $86.7 billion that it reached in mid-April after tumbling 94% since then.

Analysts, however, have expressed their skepticism. It remains unclear whether Evergrande, now close to collapsing under $305 billion in total liabilities, has the expertise or capital to compete in China’s increasingly crowded EV field.

MORE Evergrande’s Proposed Shift From Real Estate To Electric Vehicles Fails To Convince

-

26-10-2021, 02:32 AM #158Thailand Expat

- Join Date

- Mar 2007

- Last Online

- 21-10-2023 @ 08:08 AM

- Location

- Way, Way South of the border now - thank God!

- Posts

- 32,680

China: Number 1

-

26-10-2021, 10:33 AM #159Thailand Expat

- Join Date

- Feb 2017

- Last Online

- 09-04-2024 @ 05:01 PM

- Location

- One heartbeat away from eternity

- Posts

- 4,667

Dead cat bounce.

I see various figures. PH's video put Evergrande's debt at USD308.5 Billion. How do we know? The HK regulator is looking at their accounts:

"The Financial Reporting Council had identified questions about the adequacy of reporting on going concern in the accounts and the auditor's report, it said in a statement."

Hong Kong audit watchdog investigating Evergrande's 2020 accounts

Also I have seen various figures for the value of China's real estate sector. This video says 20% but earlier reports have put it at 28%. We saw what happened in Thailand whenthe tourism sector dried up, that was about 18% of GDP. If half of China's real estate market grinds to a halt that could take 10% to 15% out of their GDP. Ouch.

-

26-10-2021, 01:10 PM #160

-

26-10-2021, 05:05 PM #161

Record China Defaults in Focus as Modern Land Misses Payment

(Bloomberg) -- A Chinese developer of real estate projects that use green technologies has become the latest builder to miss debt payments, just as defaults from the nation’s borrowers on offshore bonds jump to a record.

Modern Land China Co., which is based in Beijing and builds energy-saving homes throughout the nation, didn’t repay either the principal or interest on a $250 million bond due Monday, according to a filing Tuesday morning. The company is working with its legal counsel Sidley Austin and expects to engage independent financial advisers soon, the filing said. Modern Land tried divestitures, borrowing and adding strategic investors before not making the payment, reported Chinese financial platform Cailian.

Chinese borrowers have defaulted on a record of at least $8.7 billion of offshore bonds so far this year, with the real estate industry accounting for one-third of that amount. That’s come as authorities clamp down on excessive leverage in the real estate sector amid a crisis at China Evergrande Group that has left many investors around the world on edge.

Multiple developers have defaulted this month, though Evergrande made a coupon payment last week before a grace period expired. Still, Evergrande’s creditors are bracing for an eventual debt restructuring that could rank among the largest ever in China.

Modern Land last week terminated a proposal to extend the bond’s maturity by three months. Fitch Ratings downgraded Modern Land to C from B following the proposed bond extension, considering it a “distressed debt exchange.”

Credit-rating downgrades of Chinese developers have accelerated further in October, hitting a record high for a second straight month. There were 44 cuts in the sector by Moody’s Investors Service, S&P Global Ratings and Fitch Ratings as of Oct. 21, after 34 downgrades for all of September, according to Bloomberg-compiled data.

Ratings reductions surged in the third quarter as China Evergrande Group’s troubles fueled broader debt-related worries. Ongoing downgrades, occurring as developers face heavy operational and refinancing pressure, “will worsen their capability of raising funds,” said Ma Dong, a partner with Chinese bond firm BG Capital Management Ltd.

Also hindering capital-raising is the surge in yields on Chinese junk-rated debt, recently reaching their highest in a decade at 20% and resulting in the country’s developers making up nearly half the world’s distressed dollar bonds. Still, a media representative for Ronshine China Holdings Ltd. told Bloomberg that the developer paid the $30.2 million of interest due Monday on a dollar bond. Peer Agile Group Holdings Ltd. said it has sufficient funds to meet upcoming debt maturities.

Record China Defaults in Focus as Modern Land Misses Payment

-

29-10-2021, 12:39 PM #162Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Today @ 08:19 AM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,240

House House Hearing:

PricewaterhouseCoopers Signed Off on Evergrande’s Books, Which Counted “Unbuilt and Unsold Properties” as Assets

Pam Martens and Russ Martens: October 27, 2021

"In 2012, short seller Citron Research released a 57-page report alleging fraudulent accounting at China Evergrande Group, the now teetering Chinese property development conglomerate that is causing severe anxiety in global markets. After spelling out six specific forms of accounting fraud that it believed to be taking place, the Citron report noted the following: “Meanwhile, Evergrande’s auditor, PricewaterhouseCoopers (Hong Kong office) has continued to provide an unqualified opinion.”

The author of the Citron report, Andrew Left, received a 5-year trading ban in Hong Kong by the Hong Kong Market Misconduct Tribunal over what it alleged was a false report.

On November 30, 2016, GMT Research, an accounting research firm that focuses on Asia, released a report titled: “China Evergrande: Auditors Asleep.” The report found that Evergrande had overcapitalized interest and classified its own commercial premises as an investment property.

Yesterday, those previous charges of accounting irregularities were given new meaning when a specialist from the Congressional Research Service, the research arm of Congress, testified before a House hearing and leveled her own charges.

The hearing was conducted by

The House Financial Services Committee’s Subcommittee on Investor Protection, Entrepreneurship, and Capital Markets. It was titled: “Taking Stock of China, Inc.: Examining Risks to Investors and the U.S. Posed by Foreign Issuers in U.S. Markets.”

Karen Sutter, a Specialist in Asian Trade and Finance at the Congressional Research Service, told Subcommittee members the following about Evergrande’s accounting:

“Counting unbuilt and unsold properties and interest payments as assets. About 60% of the firm’s assets are unbuilt and unsold properties, and the firm counts loan interest payments as assets. This inflates the firm’s position and increases risks if property values fall…

“Using previously-financed deals as collateral for new loans. This practice allowed the firm to accumulate debt and become leveraged…

“Investing in unrelated sectors beyond the core business. Some Chinese firms use insurance, trust, and wealth management businesses to earn higher returns and invest offshore. The Shenzhen government is investigating Evergrande’s insurance business.

“Use of complex offshore structures tied to the CEO. Evergrande uses overlapping contracts and shareholding to facilitate financial flows that make it difficult to assess liabilities. The CEO and his family reportedly hold a large share of the firm’s offshore debt.”

A report released five days before the hearing by the Congressional Research Service, assessed Evergrande’s debt levels and ability to repay creditors as follows:

“Evergrande owes about $305 billion in debt (2% of China’s GDP). The firm is obligated to repay $124 billion this year—including $19.3 billion in bonds—but may only have 10% of this amount in cash on hand. The firm is said to owe money to 171 domestic banks and 121 financial firms. Off-book liabilities have not been disclosed. As China’s largest issuer of high-yield dollar denominated debt, Evergrande was an attractive investment, despite known risks, because it paid annual interest rates of 7.5% to 14%.”

The Congressional Research Service report noted that the Evergrande situation presents critical questions for Congress, including: “Evergrande’s situation raises questions about the full scope of its liabilities and the potential direct and indirect exposure for U.S. and other firms. The role of U.S. and other underwriters and auditors of Chinese firms also raises questions about whether risks are sufficiently assessed and disclosed to investors.”

Since Evergrande was first listed on the Hong Kong stock exchange in 2009, major Wall Street firms have been among its stock underwriters, including: Bank of America Merrill Lynch, Credit Suisse, Goldman Sachs and UBS. As recently as last October, Credit Suisse, Bank of America, Huatai International and UBS arranged a secondary share offering for Evergrande. Investors will certainly be questioning the caliber of due diligence that was done by the underwriters and their legal counsel.

For almost two decades, China has stonewalled U.S. regulators over access to the work papers of auditors of publicly traded companies that are based in China but listed on U.S. stock exchanges. China has taken the position that the audit work papers hold state secrets and it prohibits audit firms from releasing the documents directly to U.S. regulators.

This past December, Congress finally addressed this critical problem. Both houses of Congress unanimously passed legislation called the Holding Foreign Companies Accountable Act. The legislation requires that the Securities and Exchange Commission (SEC) identify companies that are listed in the U.S. which the Public Company Accounting Oversight Board (PCAOB) cannot “inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction.”

The legislation also requires the listed companies to provide documentation showing that they are not owned or controlled by a governmental entity. It also mandates that the SEC prohibit the trading of the company’s stock in the U.S. if its audits cannot be inspected for three consecutive years.

Evergrande’s stock trades in Hong Kong and has lost 84 percent of its value since February. As of early this morning, its bonds are trading at 20 to 30 cents on the dollar."

https://wallstreetonparade.com/2021/10/house-hearing-pricewaterhousecoopers-signed-off-on-evergrandes-books-which-counted-unbuilt-and-unsold-properties-as-assets/

For those that tire of Nagastani words, a helpful and inclusive video has been provided.

It appears the "crème de la crème" of the NaGastaini Congress and financial auditors have been asleep at the wheel, or constantly lied, to investors.

Or were their personal rewards to be had by their failure to act

Last edited by OhOh; 29-10-2021 at 12:56 PM.

-

29-10-2021, 02:09 PM #163

These auditors are all c u n t s.

They never get held accountable for signing dodgy accounts.

-

30-10-2021, 08:59 PM #164

-

31-10-2021, 12:45 AM #165

-

31-10-2021, 04:28 AM #166Thailand Expat

- Join Date

- Mar 2007

- Last Online

- 21-10-2023 @ 08:08 AM

- Location

- Way, Way South of the border now - thank God!

- Posts

- 32,680

And the rot continues . . . like anything 'Made in China' this will fall apart as well

-

10-11-2021, 02:26 PM #167Thailand Expat

- Join Date

- Feb 2017

- Last Online

- 09-04-2024 @ 05:01 PM

- Location

- One heartbeat away from eternity

- Posts

- 4,667

I read somewhere that Evergrande had sold assets sufficient to meet today's deadline on outstanding payments due. However, no confirmation yet that the payments will be made:

Investors await Evergrande'''s overdue $148 mln payment as debt woes grow | Reuters

SHANGHAI/HONG KONG, Nov 10 (Reuters) - Cash-strapped China Evergrande Group (3333.HK) faced a Wednesday deadline for making an offshore bond payment, while a credit rating downgrade on another property firm added to mounting concerns about a liquidity squeeze in the sector.

Evergrande, the world's most indebted developer, has been stumbling from deadline to deadline in recent weeks as it grapples with more than $300 billion in liabilities, $19 billion of which are international market bonds.

The company has not defaulted on any of its offshore debt obligations, but another overdue $148 million bond payment must be made on Wednesday. There was no word on that payment as of early afternoon Asia time.

-

10-11-2021, 02:56 PM #168Thailand Expat

- Join Date

- Apr 2006

- Last Online

- Today @ 11:02 AM

- Location

- Not far from Ratchada.

- Posts

- 1,763

Well I, for one, and not rushing out to put a down payment on a Evergrande EV!

I'm fairly sure that Uncle Xi will come to the rescue. Remember the phrase "too big to fail"? It will almost certainly be applied here. (not that I think that it is anything more than a temporary fix).

-

19-11-2021, 01:12 PM #169Thailand Expat

- Join Date

- Feb 2017

- Last Online

- 09-04-2024 @ 05:01 PM

- Location

- One heartbeat away from eternity

- Posts

- 4,667

So this thing limps along. A few months from now it won't be front page news when the crunch finally comes:

Evergrande default is highly likely, S&P says

Key Points

“We still believe an Evergrande default is highly likely,” S&P Global Ratings analysts said in a report Thursday.

“The firm has lost the capacity to sell new homes, which means its main business model is effectively defunct,” the report said.

China Evergrande default is highly likely, S&P says

-

06-12-2021, 06:59 AM #170

Struggling Chinese Developer Evergrande Warns It Could Run out of Money

BEIJING —

A Chinese developer that is struggling under $310 billion in debt warned Friday it may run out of money to "perform its financial obligations" — sending regulators scrambling to reassure investors that China's financial markets can be protected from a potential impact.

Evergrande Group's struggle to comply with official pressure to reduce debt has fueled anxiety that a possible default might trigger a financial crisis. Economists say global markets are unlikely to be affected, but banks and bondholders might suffer because Beijing wants to avoid a bailout.

After reviewing Evergrande's finances, "there is no guarantee that the Group will have sufficient funds to continue to perform its financial obligations," the company said in a statement through the Hong Kong Stock Exchange.

Shortly after that, regulators tried to soothe investor fears by issuing statements saying China's financial system was strong and that default rates are low. They said most developers are financially healthy and that Beijing will keep lending markets functioning.

"The spillover impact of the group's risk events on the stable operation of the capital market is controllable," the China Securities Regulatory Commission said on its website. The central bank and bank regulator issued similar statements.

Beijing tightened restrictions on developers' use of borrowed money last year in a campaign to rein in surging corporate debt that is seen as a threat to economic stability.

The ruling Communist Party has made reducing financial risk a priority since 2018. In 2014, authorities allowed the first corporate bond default since the 1949 communist revolution. Defaults have gradually been allowed to increase in hopes of forcing borrowers and investors to be more disciplined.

Despite that, total corporate, government and household debt rose from the equivalent of 270% of annual economic output in 2018 to nearly 300% last year, unusually high for a middle-income country. Economists say a financial crisis is unlikely but that debt could drag on economic growth.

Evergrande, the global real estate industry's biggest debtor, owes 2 trillion yuan ($310 billion), mostly to domestic banks and bond investors. It also owes $19 billion to foreign bondholders.

Evergrande said it has 2.3 trillion yuan ($350 billion) in assets, but the company has struggled to turn that into cash to pay bondholders and other creditors. It called off the $2.6 billion sale of a stake in a subsidiary last October because the buyer failed to follow through on its purchase.

Evergrande's statement Friday said the company faces a demand to fulfill a $260 million obligation. It said if that obligation cannot be met, other creditors might demand repayment of debts earlier than normal.

The company has missed deadlines to pay interest on some bonds but made payments before a grace period ended and was declared in default. Evergrande also said some bondholders can choose to be paid by receiving apartments that are under construction.

The Evergrande chairman, Xu Jiayin, was summoned to meet Friday with officials of its home province of Guangdong, a government statement said. The statement said a government team would be sent to Evergrande headquarters to help oversee risk management.

Evergrande's struggle has prompted warnings that a financial squeeze on real estate — an industry that propelled China's explosive 1998-2008 economic boom — could lead to trouble for banks and an abrupt and politically dangerous collapse in growth.

Also Friday, another developer, Kaisa Group Holdings Ltd., warned it might fail to pay off a $400 million bond due next week.

A midsize developer, Fantasia Holdings Group, announced October 5 that it failed to make a $205.7 million payment due to bondholders.

Hundreds of smaller Chinese developers have gone bankrupt since regulators began tightening control over the industry's finances in 2017.

The slowdown in construction helped to depress China's economic growth an unexpectedly low 4.9% over a year earlier in the three months ending in September. Forecasters expect growth to decelerate further if the financing curbs stay in place.

Struggling Chinese Developer Evergrande Warns It Could Run out of Money

-

06-12-2021, 07:33 AM #171

Another brick in the thrall

Claims US$350 billion assets but unable to make a 260 mill payment, i,e, hasn't liquidity of 0.07428571428% suggests to me either teh valuation's inflated or a lot is incompleted off plan units for which there s a limited or no demand, plus of course like any sinking ship the insiders may well be escapeng with "golden parachutes" to start a new life retired to tropical Panama Huts?

-

07-12-2021, 05:53 AM #172

Evergrande moves toward restructuring; state swoops in to contain risk | Reuters

- Evergrande says no guarantee it can make $82.5 mln debt payments

- Says creditors have also demanded $260 mln repayment

- Authorities summon chairman; shares drop 20% to all-time low

- Disorderly collapse could ripple through property sector

HONG KONG, Dec 6 (Reuters) - China Evergrande Group (3333.HK) has set up a risk management committee as the cash-strapped property developer inches closer to a debt restructuring that has loomed for months over global markets and the world's second-largest economy.

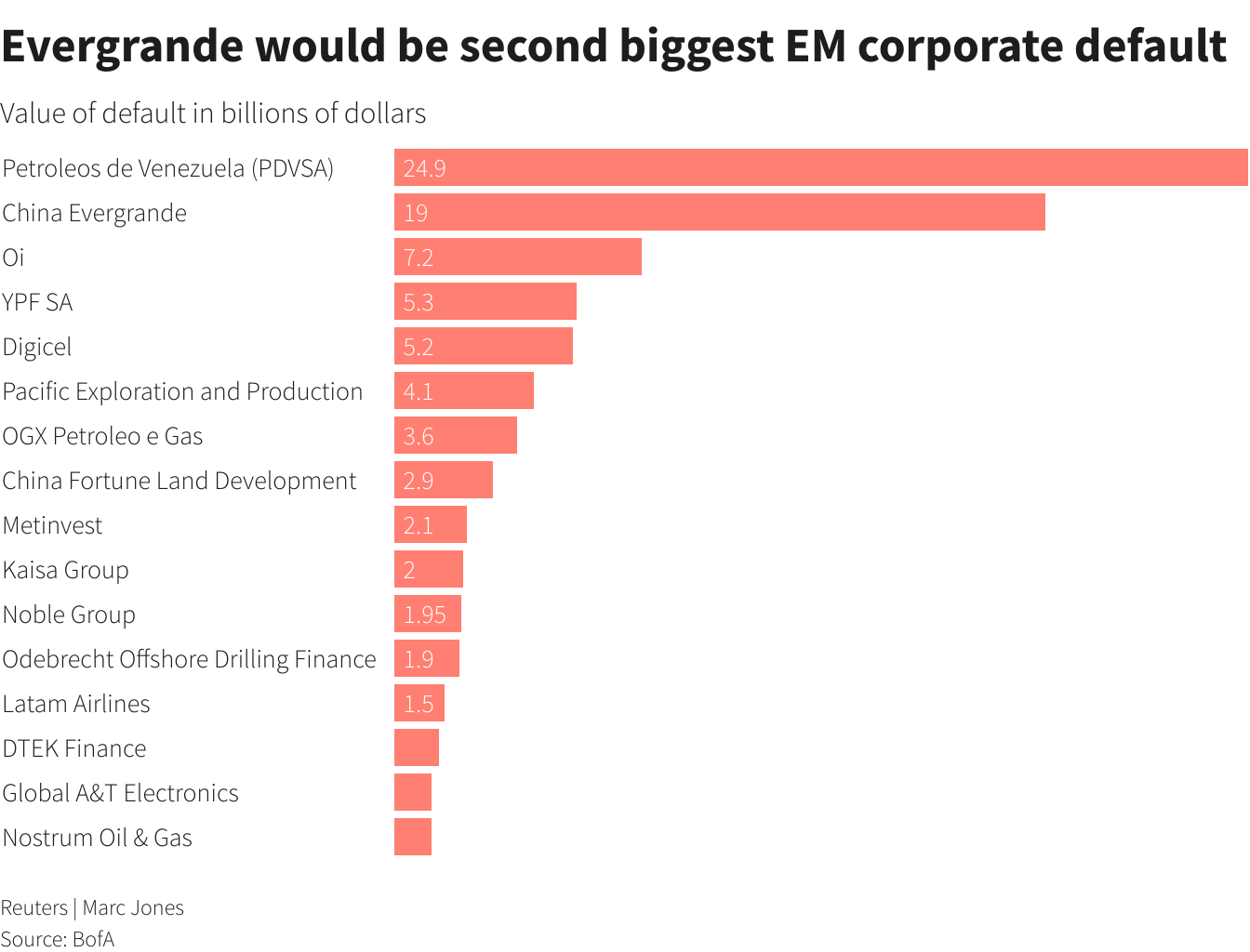

The real estate giant, which is grappling with over $300 billion in liabilities and is at risk of becoming China's biggest ever default, said on Monday that the committee included officials from state entities and would play an important role in "mitigating and eliminating the future risks" of the group.

On Friday, Evergrande said it would seek to restructure its offshore debt after acknowledging that it may no longer be able to meet its financial obligations, prompting the provincial government of the southern province of Guangdong, where it is based, to step in to help manage the fallout. read more

Register now for FREE unlimited access to reuters.com

Register

"Evergrande's been trying to sell assets to repay debt, but Friday's statement basically says it is going to 'surrender' and needs help," said Conita Hung, investment strategy director at Tiger Faith Asset Management. "This sends a very bad signal."

Evergrande shares slumped to a record low on Monday as it teetered, yet again, on the brink of default with the end of a 30-day grace period looming on dues totalling $82.5 million.

At the end of Asia business hours, two bondholders said they had yet to receive payments.

Evergrande, which has made 11th-hour coupon payments in the past, declined to comment.

If Evergrande was declared in formal default it would trigger a wave of cross defaults that would ripple through the property sector and beyond, potentially rattling global investor confidence, already shaken by the emergence of the Omicron variant of the coronavirus. read more

"Until there is a further announcement everybody is waiting to see if this time will be the first real trigger event. This is also set against the anticipated febrile equities market this week," said Karl Clowry, a partner at Addleshaw Goddard in London.

Reuters Graphics Reuters GraphicsChinese authorities have ramped up efforts to reassure markets that Evergrande's woes can be contained.

In the latest move, China's central bank said on Monday it would cut the amount of cash that banks must hold in reserve, its second such move this year, releasing $188 billion in long-term liquidity to bolster slowing economic growth. read more

Evergrande's shares tumbled 20% on Monday closing at an all-time low of HK$1.81 after it said late on Friday that creditors had demanded $260 million and that it could not guarantee funds for coupon repayment, prompting authorities to summon its chairman.

Analysts said authorities' concerted efforts signalled Evergrande has likely already entered a managed debt-asset restructuring process.

Morgan Stanley said such a process would involve coordination between authorities to maintain operations of property projects, and negotiation with onshore creditors to ensure financing for project completion.

Regulators would also likely facilitate debt restructuring discussion with offshore creditors after operations stabilise, the U.S. investment bank said in a report.

The recent tumble in Evergrande's dollar-denominated bonds accelerated with the March 2022 issue dropping 4.35 cents in the dollar to 27.7 cents, while other issues like the 2024 and 2025 bonds , tumbled to record lows below 20 cents, MarketAxess data showed.

1/2A traffic light is seen near the headquarters of China Evergrande Group in Shenzhen, Guangdong province, China September 26, 2021. REUTERS/Aly Song

LIQUIDITY SQUEEZE

The firm is just one of a number of developers starved of liquidity due to regulatory curbs on borrowing, prompting offshore debt defaults, credit-rating downgrades and sell-offs in developers' shares and bonds.

To stem turmoil, regulators since October have urged banks to relax lending for developers' normal financing needs and allowed more real estate firms to sell domestic bonds. read more

Still, the government may have to significantly step up policy-easing measures in the spring to prevent a sharp downturn in the property sector as repayment pressures intensify, Japanese investment bank Nomura said in a report on Sunday.

Quarterly dollar bond repayments will almost double to $19.8 billion in the first quarter and $18.5 billion in the second.

Easing measures such as the ability to sell domestic bonds are unlikely to help Evergrande refinance as there would be no demand for its notes, CGS-CIMB Securities said on Monday.

Evergrande's inability to sell projects - with almost zero November sales - also makes short-term debt payments "highly unlikely", the brokerage said.

On Monday, smaller developer Sunshine 100 China Holdings Ltd (2608.HK) said it had defaulted on a $170 million dollar bond due Dec. 5 "owing to liquidity issues arising from the adverse impact of a number of factors including the macroeconomic environment and the real estate industry". read more

The delinquency will trigger cross-default provisions under certain other debt instruments, it said.

Last week, Kaisa Group Holdings Ltd (1638.HK), China's largest offshore debtor among developers after Evergrande, said bondholders had rejected an offer to exchange its 6.5% offshore bonds due Dec. 7 , leaving it at risk of default.

The developer has begun talks with some of the bondholders to extend the deadline for the $400 million debt repayment, sources have told Reuters. read more

Smaller rival China Aoyuan Property Group Ltd (3883.HK) last week also said creditors have demanded repayment of $651.2 million due to a slew of credit-rating downgrades, and that it may be unable to pay due to a lack of liquidity. read more

Aoyuan Chairman Guo Zi Wen on Friday told executives at an internal meeting to have a "wartime mindset" to ensure operation and project delivery and to fund repayments, a person with direct knowledge of the matter told Reuters.

Such tasks will be priorities for the developer, which will leave bond repayment negotiation to professional institutions in Hong Kong, said the person, declining to be identified as the matter is private.

Aoyuan did not respond to a request for comment.

The developer's share price fell nearly 8% on Monday. Kaisa lost 2.2% and Sunshine 100 plunged 14%.

($1 = 6.3724 Chinese yuan renminbi)

Register now for FREE unlimited access to reuters.com

Register

Reporting by Clare Jim in Hong Kong; Additional reporting to Shuyan Wang in Beijing and Andrew Galbraith in Shanghai; editing by Anne Marie Roantree, Jason Neely and Carmel CrimminsLast edited by david44; 07-12-2021 at 03:47 PM. Reason: skin lightening

-

07-12-2021, 06:50 AM #173Thailand Expat

- Join Date

- Mar 2007

- Last Online

- 21-10-2023 @ 08:08 AM

- Location

- Way, Way South of the border now - thank God!

- Posts

- 32,680

They're farked and many will suffer

No difference between medium, large or huge - they'll fuck it up.

-

07-12-2021, 02:06 PM #174Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Today @ 08:19 AM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,240

China to cut RRR by 50 basis points as top leadership stresses economic stability in key meeting

Top leadership stresses economic stability in tone-setting meeting

By Li Qiaoyi

and Xie Jun

"China's central bank announced on Monday a 50 basis-point universal cut in the reserve requirement ratio (RRR) for financial institutions, effective from December 15, which would inject 1.2 trillion yuan ($188.3 billion) in long-term liquidity into the economy, as the country's top leadership stressed stability in economic development in 2022 at a tone-setting meeting on Monday.

The Political Bureau of the Communist Party of China (CPC) Central Committee held a meeting on Monday to analyze and study the economic work of 2022, among other topics, according to the Xinhua News Agency.

The CPC leadership meeting stressed that China's economic development maintained a globally leading position in 2021 and economic work for 2022 will prioritize stability, while keeping in place proactive fiscal and prudent monetary policies.

The broad-based RRR cut on Monday, the second this year, comes at a critical moment as the Chinese economy is on a path to hit its annual growth target, and the move would cushion the downward pressure on the economy and reduce financing costs, especially for smaller businesses, economists said.

....

Shortly after the news, three major Chinese financial regulators, including the PBC, the banking and insurance regulator and the securities regulator, in rare simultaneous statements, moved to reassure the markets that the Evergrande issue was an individual case and should not be a concern for the country's capital market and housing market.

"For the property market, which relies heavily on financing, it would have lower fundraising costs after the RRR cut. Besides, liquidity injections will improve corporations' business performance, which would also improve employment to some extent," Xi Junyang, a professor at the Shanghai University of Finance and Economics, told the Global Times on Monday.

The latest move is seen as cementing market belief that the economy is well on course to meet its 2021 full-year growth target of above 6 percent.

An economic blue paper published by the Chinese Academy of Social Sciences on Monday put China's full-year GDP growth at 8 percent for 2021 before slowing to around 5.3 percent in 2022 amid uncertainty over the pandemic.

In another sign of official reassurance, Vice Premier Liu He told the Hamburg Summit of the China-Europe Forum at the end of November that the Chinese economy is expected to exceed its annual growth target.

The Monday announcement, apparently contrary to a bond-buying taper tightrope the US Federal Reserve walks, indicates China's monetary policy independence as the country has more flexibility and leeway in enabling targeted financial support for the economy, analysts said.

Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies at Renmin University of China, said that China's roll-out of the RRR cut at a time when the US is speeding up its tapering shows that China's monetary policies are "centered on our own needs" instead of "dancing with others."

According to Dong, China did not release liquidity at an earlier stage, which gives the PBC room to do so now.

The US, on the contrary, has released liquidity without restraint for some time, which has pushed it to cut the scale of debt purchases.

Dong also said that China's RRR cut is a reflection of the philosophy of "flexible as well as precise," as China's economic conditions, with third-quarter GDP growth heading down, raise the requirements for boosting investment and providing liquidity for the real economy. Besides, China has not flooded the market or over-stimulated the economy by increasing the monetary base, meaning that monetary policy is still stable, he said"

China to cut RRR by 50 basis points as top leadership stresses economic stability in key meeting - Global Times

-

07-12-2021, 03:08 PM #175

It's being propped up.

China Evergrande teeters again, but investors less fearful | The StandardChina's central bank has pumped 1.2 trillion yuan (US$188 billion) into the banking system, its second such move since July, and the regional government where Evergrande is based has said it is now stepping in.

Better hurry up and borrow some of that and pay their bills, before it dries up.

Some Evergrande bondholders not received overdue coupon payments -sources | ReutersHONG KONG/SHANGHAI, Dec 7 (Reuters) - Some offshore bondholders of China Evergrande Group (3333.HK) did not receive coupon payments by the end of a 30-day grace period on Monday New York time, four people with knowledge of the matter said.

A failure to make $82.5 million in interest payments that had been due last month could represent the developer's first offshore default on a public bond.

Such a default would trigger cross-defaults on all the company's about $19 billion of bonds in international capital markets and put Evergrande at risk of becoming China's biggest-ever defaulter, which would ripple through the property sector and beyond, further rattling global investor confidence.

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Reply With Quote

Reply With Quote