Results 2,051 to 2,075 of 3124

Thread: The View, from China

-

25-10-2022, 07:47 AM #2051

-

25-10-2022, 08:08 AM #2052Thailand Expat

- Join Date

- Feb 2006

- Last Online

- @

- Posts

- 38,456

It definitely shows that more folk should read my View from China thread, and get a balanced perspective rather than the biased narrative coming largely from an increasingly insecure and nervous USA.

-

25-10-2022, 08:49 AM #2053

-

25-10-2022, 08:54 AM #2054Thailand Expat

- Join Date

- Feb 2006

- Last Online

- @

- Posts

- 38,456

Think you will find the Australian media sector is not quite as large as the USA, and our biggest proprietor is one Rupert Murdoch. Not too many global geopolitical narratives are originated down under.

-

25-10-2022, 09:34 AM #2055

-

25-10-2022, 09:47 AM #2056Thailand Expat

- Join Date

- Feb 2006

- Last Online

- @

- Posts

- 38,456

Oh we're quite wise to Prince Rupert alright.

-

25-10-2022, 09:54 AM #2057

The debt crisis that roiled China’s real estate market has spread to one of the country’s largest conglomerates. Fosun, owner of an English Premier league soccer team, Portugal’s largest bank and Club Med, can no longer raise capital so it must sell off assets before it defaults on its short-term debt.

Fire Sale! China’s “Warren Buffett” Races To Sell AssetsThe next post may be brought to you by my little bitch Spamdreth

-

25-10-2022, 09:55 AM #2058

(Bloomberg) -- Foreign investors are on track to turn sellers of Chinese equities for the first time ever for the year, as concerns about a lack of supportive policies from the Party congress and a renewed Covid Zero push spook markets.

Overseas investors sold a record net 17.9 billion yuan ($2.5 billion) of mainland shares via trading links with Hong Kong on Monday, according to Bloomberg data, tipping the year-to-date level into a small net outflow. If that holds through year end, it would be the first annual decline since the stock connect program was launched in 2014.

Panic selling hit markets on Monday following the nationís twice-a-decade political event, with the Hang Seng China Enterprises Index tumbling to the lowest level since the 2008 financial crisis. President Xi Jinpingís consolidation of power was seen as a major risk, with expectations that the leadership reshuffle would bring a continuation of key policies like Covid Zero.

Foreigners Flee China Stocks at Record Pace as Panic Spreads - BNN Bloomberg

-

25-10-2022, 09:56 AM #2059

It seems even the chinkies don't like him.

A SENSE of exasperation swept across Chinese markets as President Xi Jinping moved to stack his leadership ranks with loyalists, with stocks capping their worst day in Hong Kong since the 2008 global financial crisis and the yuan weakening to a 14-year low.

https://www.businesstimes.com.sg/gov...oreigners-flee

-

25-10-2022, 09:59 AM #2060Thailand Expat

- Join Date

- Feb 2017

- Last Online

- 09-04-2024 @ 05:01 PM

- Location

- One heartbeat away from eternity

- Posts

- 4,667

"Guo Guangchang, the billionaire cofounder of Chinese conglomerate Fosun, likes to say that he emulates Warren Buffett by following the same investment strategy of using the steady cash flow from insurance firms to acquire other businesses.

But now, Guo is struggling with a problem Buffett never had. Fosun had been borrowing heavily to fund its acquisition spree and analysts are concerned that it doesn’t have the cash to cover its short-term liabilities. "

So, nothing like Warren Buffet in fact.

-

25-10-2022, 10:05 AM #2061Thailand Expat

- Join Date

- Feb 2006

- Last Online

- @

- Posts

- 38,456

Xiís Pledge At Congress Means Getting Rich Quick Is Out. Should Luxury Worry?

What Happened: Op-eds have emerged in Chinese newspapers explaining in detail the implications of Chinese President Xi Jinping’s pledge at the 20th National Congress to achieve common prosperity. The focus is on the key phrase “regulating the order of income distribution and the mechanism of wealth accumulation,” or 规范收入分配秩序,规范财富积累机制, which has appeared for the first time in government documents.

One op-ed in state media outlet The Beijing News cited Su Hainan, a researcher at the China Association for Labor Studies, who stated that “a select few have gotten rich extremely fast [暴富] through property income such as investments, stocks, and bonds … especially in industries like finance and Internet.” Su advocates for the use of “taxation, laws, and other related means to adjust the phenomenon of accumulating wealth too quickly.”

On the major economic news platform Yicai, another op-ed called for elevating labor’s role (劳动力) in income distribution, arguing that it will create a fairer job market and boost domestic consumption. Revising income tax is an effective tool to curb excessive income, the op-ed argued, although the goal should be not to “kill the rich but to aid the poor” (杀富济贫), and so cautions against blindly raising the tax rate, which may disincentivize production. The piece also states that voluntary redistribution from the rich, known as “the third distribution” (三次分配) following that of income and government, should also be encouraged.

The Jing Take: The luxury industry should anticipate more forceful actions from the Chinese government to ameliorate the mainland’s wealth disparity in the wake of the congress. One measure which might have the most direct impact on the sector is the introduction of a luxury tax, an idea that has been proposed by the country’s lawmakers in the past. Such a tax would target what the Chinese government considers to be highly expensive and “unnecessary” consumer products to curb excess materialism. There is no definitive answer for when such legislation would be introduced, but its possibility has certainly increased after the 20th National Congress explicitly mentioned “income distribution.”

Another major impact on luxury will be the government’s more visible disapproval of speculative purchases since they fall into the category of “getting rich too quickly.” In recent years, China has witnessed resale frenzies surrounding sneakers, art toys, digital collectibles, and even luxury packaging. It is likely that the central government will unveil formal legislation that strictly regulates the consumer goods resale market in an attempt to root out wild price fluctuations. This means that, when building hype for special collections, companies should avoid using languages and actions that can be interpreted as encouraging purchases for potential resale values.

In addition, luxury houses should prepare to have their pricing rationale more closely scrutinized. Drawing attention to the fact that luxury products convey exclusivity will reflect poorly on a brand, especially amid the broader push to achieve Xi’s common prosperity policy. Instead, the emphasis should be on the labor aspect of a product, such as its exquisite craftsmanship and ingenious design, as well as the spiritual value that it can offer to Chinese consumers. Local corporate social responsibility and philanthropic initiatives are also now a must for luxury houses. They not only showcase labels’ willingness to participate in the “third distribution,” but also their commitment to promoting China’s overall social development — which benefits the underprivileged especially.

The Jing Take reports on a piece of the leading news and presents our editorial team’s analysis of the key implications for the luxury industry. In the recurring column, we analyze everything from product drops and mergers to heated debate sprouting on Chinese social media.

https://jingdaily.com/20th-national-...gulate-income/

Eat the Rich.

-

26-10-2022, 05:40 AM #2062Thailand Expat

- Join Date

- Aug 2017

- Last Online

- Today @ 02:59 PM

- Location

- Sanur

- Posts

- 8,084

-

27-10-2022, 12:17 PM #2063Thailand Expat

- Join Date

- Feb 2006

- Last Online

- @

- Posts

- 38,456

-

27-10-2022, 01:30 PM #2064

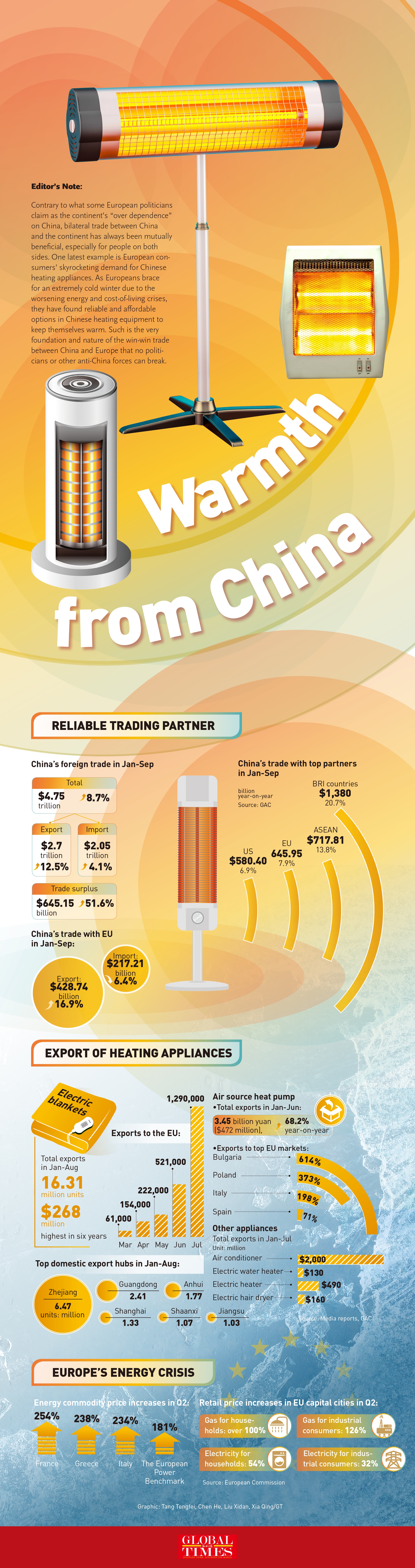

Gas for households: over 100%

Electrcity for households: 54 %

Oh dear

If only

-

27-10-2022, 02:55 PM #2065

Well done sabang. Quite a feat to think you can describe chinky loan sharking and grabbing of assets and resources as "trade".

-

27-10-2022, 07:39 PM #2066Thailand Expat

- Join Date

- Feb 2006

- Last Online

- @

- Posts

- 38,456

What a shame that Europeans are queuing up to buy electric blankets from China, so they can make it through the winter.

-

27-10-2022, 08:29 PM #2067Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Today @ 08:19 AM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,240

COSCO buys 24.9% stake in Hamburg terminal

By CHEN WEIHUA in Brussels | chinadaily.com.cn | Updated: 2022-10-27 16:37

"The Hamburg port operating company, HHLA, welcomed a compromise decision announced by the German federal government on Wednesday for Chinese company COSCO Shipping Port Ltd (CSPL) to buy a stake in one of its three terminals. The German cabinet agreed to allow CSPL to acquire a 24.9-percent stake instead of the initially planned 35 percent in the container terminal Tollerort in Hamburg in northern Germany.

"We appreciate that a solution has been found through objective and constructive talks with the federal government," Angela Titzrath, chairwoman of HHLA's executive board, said in a press release on Wednesday.

German Minister for Economic Affairs and Climate Action Robert Habeck, of the Greens party, and the Free Democrats, another partner in the three-way coalition government, had voiced concerns about selling what they called a critical infrastructure facility to a Chinese company.

Some German lawmakers have fearmongered the project, saying it was creating dependency on China like Germany's dependency on Russian energy.

German Chancellor Olaf Scholz, a Social Democrat and former mayor of Hamburg, has supported the deal and dismissed the criticism.

A federal government spokeswoman said on Wednesday that the chancellor had made clear that the bid was not about selling the port, but "merely" a stake in a single terminal.

According to the deal, CSPL will have no voting rights, meaning no say in management or strategic decisions.

HHLA and CSPL had signed an agreement in September last year in which the Chinese company would acquire a minority share of 35 percent in Container Terminal Tollerort. The review process by the federal government dragged on until well into this year. In August, HHLA and CSPL agreed to extend the deadline until Oct 31 in order to bring the process to a successful conclusion.

"We want to continue to successfully develop the business relationship with COSCO that has existed for 40 years," Titzrath said.

HHLA said that with CSPL's investment, CTT, the terminal company in which CSPL has 24.9 percent stake, will become a preferred hub for Asian traffic.

HHLA claims that it retains sole control over all major decisions, and COSCO will not receive any exclusive rights to CTT, and that the terminal will remain open to container volumes from all customers.

"The cooperation between HHLA and COSCO creates no one-sided dependencies. Quite the opposite: it strengthens supply chains, secures jobs and promotes value creation in Germany," the company said.

It said that cooperation between the two partners also strengthens the position of Hamburg as a logistics hub in the North Sea and Baltic Sea regions and of the Federal Republic of Germany as an export nation.

The company said that open and free world trade is the basis for a city like Hamburg.

"A company like HHLA must and wants to maintain good relations with its Chinese trading partners," HHLA said.

Hans-Jorg Heims, a spokesman for HHLA, said earlier that the issue had been unduly politicized. He argued that without Chinese investment, Hamburg will be at a disadvantage against other European competitors in which COSCO has a stake, such as in Rotterdam and Antwerp.

Chinese Foreign Ministry spokesman Wang Wenbin said on Wednesday that China-Germany cooperation is mutually beneficial.

"Cooperation benefits both sides. We hope relevant parties will view China-Germany practical cooperation in a rational light and stop groundless hype," he told a daily briefing in Beijing in response to a question about the potential deal.

Lai Suetyi, an associate professor in the Center for European Studies at the Guangdong University of Foreign Studies, said that investment of a State-owned Chinese firm in Hamburg port, the third-largest in Europe, can no longer be a purely economic project in today's context.

The soaring energy price, the Russia-Ukraine conflict together with supply chain interruption "lead to politicalization of any issue with 'systemic rival' like China," she said, referring to European Union's policy in past years describing China as a cooperation partner, economic competitor and systemic rival."

COSCO buys 24.9% stake in Hamburg terminal - Chinadaily.com.cn

Germany finds compromise over Chinese Hamburg terminal deal

- By KIRSTEN GRIESHABER - Associated Press

- Oct 26, 2022 Updated Oct 26, 2022

Germany finds compromise over Chinese Hamburg terminal dealLast edited by OhOh; 27-10-2022 at 08:53 PM.

A tray full of GOLD is not worth a moment in time.

-

28-10-2022, 08:36 AM #2068

-

29-10-2022, 12:08 PM #2069Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Today @ 08:19 AM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,240

How does the CPC elect its top leaders?

chinadaily.com.cn | Updated: 2022-10-21 09:58

A short illustrated slide show, explainer. Is here:

How does the CPC elect its top leaders? - Chinadaily.com.cn

-

29-10-2022, 01:30 PM #2070Thailand Expat

- Join Date

- Feb 2006

- Last Online

- @

- Posts

- 38,456

So when a US multinational takes a stake in, or takes over, a foreign company- that is for charity?The chinkies don't do anything except for their own benefit

-

29-10-2022, 02:22 PM #2071Thailand Expat

- Join Date

- Jul 2010

- Last Online

- Today @ 08:19 AM

- Location

- Where troubles melt like lemon drops

- Posts

- 25,240

Foreign Ministry Spokesperson Wang Wenbin’s Regular Press Conference on October 28, 2022

Dragon TV:

On October 27 local time, the US Department of Defense released the 2022 Nuclear Posture Review (NPR). Do you have any comment?

Wang Wenbin:

"We noted that the US 2022 Nuclear Posture Review hypes up major-power competition and bloc confrontation and smacks heavily of Cold War and zero-sum mentality. It uses nuclear weapons as tools to advance its geopolitical agenda. This is clearly against the world’s desire to prevent a nuclear war or nuclear arms race.

I need to highlight the fact that the US has the largest nuclear arsenal in the world, and continues to upgrade its “nuclear triad” and selectively advances the international nuclear arms control process only when doing so serves to suppress the countries it sees as rivals. What’s behind the US policy is its hegemonic logic of seeking absolute military superiority, which could stoke a nuclear arms race.

The US claims it would use nuclear weapons in response to a nuclear or non-nuclear strategic attack and seek to develop or forward-deploy non-strategic nuclear weapons. The US has placed more importance on the role of nuclear weapons in national security policy and lowered the threshold for using nuclear weapons, which has gradually become a source of risks for nuclear conflict.

The US has been hyping up the so-called nuclear threat from certain countries, “tailoring” nuclear deterrence strategies targeting these countries and calling for “nuclear sharing” that violates the NPT. It has also tried to reinforce its extended deterrence commitments to its allies in the Asia Pacific. The US moves have undermined mutual trust between major countries, stoked nuclear arms race and confrontation, stimulated nuclear proliferation, and seriously harmed regional and international peace and stability.

I need to stress that in this latest NPR, the US has made irresponsible remarks and accusations as well as groundless speculations on China’s normal modernization of its nuclear forces. The US has brazenly “tailored” a nuclear deterrence strategy against China. China is seriously concerned about and firmly opposed to such a move. Let me make it clear that we have the capability and confidence to safeguard our national security interests. The US’s nuclear blackmail will not work on China.

China urges the US to abandon the Cold War mentality and the logic of hegemonism, pursue a rational and responsible nuclear policy, fulfill its special and primary responsibility in nuclear disarmament, and play its due role in maintaining global strategic stability and world peace and security. "

Foreign Ministry Spokesperson Wang Wenbin’s Regular Press Conference on October 28, 2022

-

29-10-2022, 04:18 PM #2072

-

29-10-2022, 04:20 PM #2073

-

29-10-2022, 06:27 PM #2074

-

30-10-2022, 04:12 AM #2075Thailand Expat

- Join Date

- Feb 2006

- Last Online

- @

- Posts

- 38,456

Wot, and live next to you? no thanks.

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Reply With Quote

Reply With Quote