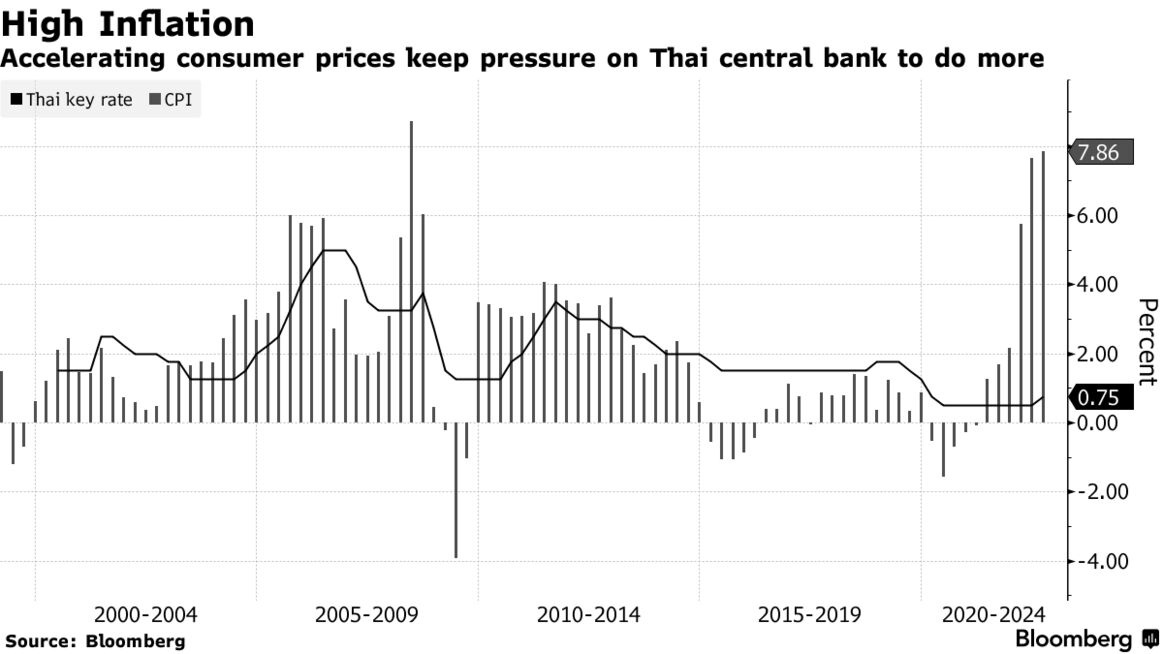

Thai Inflation at New 14-Year High Boosts Case for Rate Hikes

- Core inflation has been quickening since start of the year

- Central banker says watchful of second-round inflation

By Suttinee Yuvejwattana and Anuchit Nguyen (Bloomberg)

September 5, 2022 at 11:09 AM GMT+7

Thailand’s inflation accelerated to a fresh 14-year high in August, supporting the case for the central bank to continue with its monetary policy tightening.

The consumer price index rose 7.86% last month from a year ago, the most since July 2008, the Commerce Ministry said Monday. Core inflation, which strips out volatile food and fuel items, was 3.15% in August and quickening steadily since the start of the year. While both data were below most economists estimates, the rates were well above the Bank of Thailand’s 1%-3% target range.

The inflation print is the last before the central bank’s next policy meeting on Sept. 28. BOT Governor Sethaput Suthiwartnarueput, at a separate briefing on Monday, reiterated that the rate-panel will stick with its gradual and measured policy tightening path and that it’s not appropriate for Thailand to follow the Federal Reserve’s aggressive stance.

Still, Sethaput said the BOT is concerned about rising core inflation that may signal that price engines are firing up even as he reaffirmed a call that price gains will peak this quarter and cool to within the 1%-3% target in 2023. The governor said much of the pressure remains costs-driven and there’s “not much sign” they’re demand driven, ruling out a wage-price spiral.

Broader and slightly faster price increases for Thailand in August risks stoking inflation expectations as the economy reopens from the pandemic and wages accelerate. This should reinforce the Bank of Thailand’s resolve to tighten monetary policy further on Sept. 28, when we expect it to raise the key rate by another 25 basis points.

-- Tamara Mast Henderson, Asean economist

An impending hike in minimum wages, rising prices of items like instant noodles and a possible increase in cab fares are evidence of second-round inflation effects. A weak local currency also risk adding to pressures in the near term while heavy rains and flooding in Thailand where 59 provinces are under monitoring, could also stoke prices.

The baht fell as much as 0.4% on Monday against the dollar and is the third-worst performer in the region this month.

Thailand’s minimum wage, frozen since January 2020, is set to rise by an average 5% from Oct. 1 to help workers cope. Even with more money in their pockets, many Thais will find their pay increases eaten up by the cost of goods they buy.

— With assistance by Patpicha Tanakasempipat

Results 1 to 1 of 1

Thread: Thai Inflation Heating Up

-

05-09-2022, 03:26 PM #1

Thai Inflation Heating Up

Majestically enthroned amid the vulgar herd

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Reply With Quote

Reply With Quote